JetBlue Airlines 2010 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2010 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

concluded these embedded derivatives were either (i) excluded from bifurcation as a result of being clearly

and closely related to the 6.75% Debentures or are indexed to our common stock and would be classified

in stockholders’ equity if freestanding or (ii) are immaterial embedded derivatives.

(7) In March 2005, we completed a public offering of $250 million aggregate principal amount of 3.75%

convertible unsecured debentures due 2035, or 3.75% Debentures.

In 2008, we repurchased approximately $73 million principal amount of our 3.75% Debentures for

$54 million. The $14 million net gain from these transactions is recorded in interest income and other in

the accompanying consolidated statements of operations.

During 2009, we repurchased approximately $20 million principal amount of our 3.75% Debentures at a

slight discount to par. Of the total consideration paid, $2 million was allocated to the reacquisition of the

equity component, resulting in a $2 million gain on the extinguishment of debt after writing off

unamortized debt discount and issuance costs.

In March 2010, holders of these 3.75% Debentures required us to repurchase approximately $155 million

aggregate principal amount of Debentures for cash on the first repurchase date at the repurchase price

equal to 100% of their principal amount plus accrued and unpaid interest. In August 2010, we redeemed

the remaining $1 million principal amount of the 3.75% Debentures at par, plus accrued interest.

Prior to the repurchase of these Debentures, we accounted for this convertible debt under the provisions of

the Codification which applies to all convertible debt instruments that have a “net settlement feature”,

which means instruments that by their terms may be settled either wholly or partially in cash upon

conversion. Under these provisions, the liability and equity components of convertible debt instruments

that may be settled wholly or partially in cash upon conversion must be accounted for separately in a

manner reflective of their issuer’s nonconvertible debt borrowing rate. Since our 3.75% Debentures had an

option to be settled in cash, they were within the scope of this accounting guidance.

Our effective borrowing rate for nonconvertible debt at the time of issuance of the 3.75% Debentures was

estimated to be 9%, which resulted in $52 million of the $250 million aggregate principal amount of

debentures issued, or $31 million after taxes, being attributed to equity. We amortized the debt discount

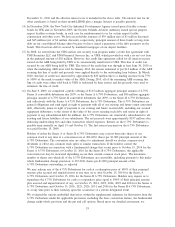

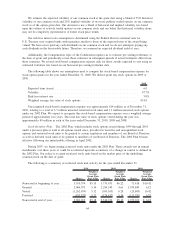

through March 2010, the first repurchase date of the debentures. The principal amount, unamortized

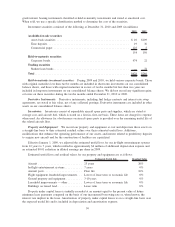

discount and net carrying amount of the debt and equity components are presented below (in millions):

As of

December 31,

2009

Principal amount..................................................... $156

Unamortized discount ................................................. (2)

Net carrying amount .................................................. $154

Additional paid-in capital, net ........................................... $ 29

Interest expense related to these debentures consisted of the following (in millions):

2010 2009 2008

3.75% contractual rate ........................................... $1 $ 6 $ 9

Discount amortization ........................................... 2 8 10

Total interest expense........................................... $3 $14 $19

Effective interest rate ............................................ 9% 9% 9%

(8) On June 4, 2008, we completed a public offering of $100.6 million aggregate principal amount of 5.5%

Series A convertible debentures due 2038, or the Series A 5.5% Debentures, and $100.6 million aggregate

principal amount of 5.5% Series B convertible debentures due 2038, or the Series B 5.5% Debentures, and

collectively with the Series A 5.5% Debentures, the 5.5% Debentures. The 5.5% Debentures are general

senior obligations secured in part by an escrow account for each series. We deposited approximately

$32 million of the net proceeds from the offering, representing the first six scheduled semi-annual interest

payments on the 5.5% Debentures, into escrow accounts for the exclusive benefit of the holders of each

56