JetBlue Airlines 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 5—Stockholders’ Equity

In May 2010, at our annual meeting of stockholders, shareholders approved an amendment to our

Amended and Restated Certificate of Incorporation to increase the Company’s authorized capital from

500 million common shares to 900 million common shares. Our authorized shares of capital stock also consist

of 25 million shares of preferred stock. The holders of our common stock are entitled to one vote per share on

all matters which require a vote by the Company’s stockholders as set forth in our Amended and Restated

Certificate of Incorporation and Bylaws.

On June 9, 2009, in conjunction with the public offering of the 6.75% Debentures described in Note 2,

we also completed a public offering of 26,450,000 shares of our common stock at a price of $4.25 per share,

raising net proceeds of approximately $109 million, after deducting discounts and commissions paid to the

underwriters and other expenses incurred in connection with the offering. Approximately 15.6% of this

offering was reserved for and purchased by Deutsche Lufthansa AG, to allow them to maintain their pre-

offering ownership percentage.

Pursuant to our amended Stockholder Rights Agreement, which became effective in February 2002, each

share of common stock has attached to it a right and, until the rights expire or are redeemed, each new share

of common stock issued by the Company will include one right. Upon the occurrence of certain events

described below, each right entitles the holder to purchase one one-thousandth of a share of Series A

participating preferred stock at an exercise price of $35.55, subject to further adjustment. The rights become

exercisable only after any person or group acquires beneficial ownership of 15% or more (25% or more in the

case of certain specified stockholders) of the Company’s outstanding common stock or commences a tender or

exchange offer that would result in such person or group acquiring beneficial ownership of 15% or more (25%

or more in the case of certain stockholders) of the Company’s common stock. If after the rights become

exercisable, the Company is involved in a merger or other business combination or sells more than 50% of its

assets or earning power, each right will entitle its holder (other than the acquiring person or group) to receive

common stock of the acquiring company having a market value of twice the exercise price of the rights. The

rights expire on April 17, 2012 and may be redeemed by the Company at a price of $.01 per right prior to the

time they become exercisable.

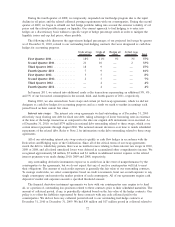

As of December 31, 2010, we had a total of 186.9 million shares of our common stock reserved for

issuance related to our CSPP, our 2002 Plan, our convertible debt, and our share lending facility. As of

December 31, 2010, we had a total of 27.6 million shares of treasury stock, almost all of which resulted from

the return of borrowed shares under our share lending agreement. Refer to Note 2 for further details on the

share lending agreement and Note 7 for further details on our share-based compensation.

62