JetBlue Airlines 2010 Annual Report Download - page 58

Download and view the complete annual report

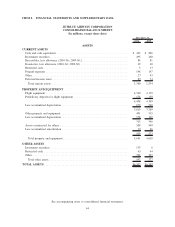

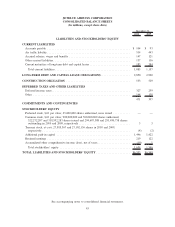

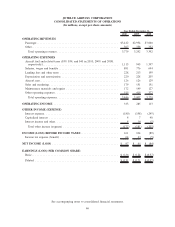

Please find page 58 of the 2010 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.JETBLUE AIRWAYS CORPORATION

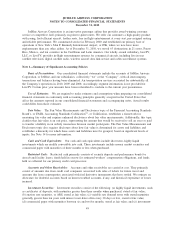

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2010

JetBlue Airways Corporation is an innovative passenger airline that provides award winning customer

service at competitive fares primarily on point-to-point routes. We offer our customers a high quality product

with young, fuel-efficient aircraft, leather seats, free in-flight entertainment at every seat, pre-assigned seating

and reliable performance. We commenced service in February 2000 and established our primary base of

operations at New York’s John F. Kennedy International Airport, or JFK, where we now have more

enplanements than any other airline. As of December 31, 2010, we served 63 destinations in 21 states, Puerto

Rico, Mexico, and ten countries in the Caribbean and Latin America. Our wholly owned subsidiary, LiveTV,

LLC, or LiveTV, provides in-flight entertainment systems for commercial aircraft, including live in-seat

satellite television, digital satellite radio, wireless aircraft data link service and cabin surveillance systems.

Note 1—Summary of Significant Accounting Policies

Basis of Presentation: Our consolidated financial statements include the accounts of JetBlue Airways

Corporation, or JetBlue, and our subsidiaries, collectively “we” or the “Company”, with all intercompany

transactions and balances having been eliminated. Air transportation services accounted for substantially all

the Company’s operations in 2010, 2009 and 2008. Accordingly, segment information is not provided for

LiveTV. Certain prior year amounts have been reclassified to conform to the current year presentation.

Use of Estimates: We are required to make estimates and assumptions when preparing our consolidated

financial statements in conformity with accounting principles generally accepted in the United States that

affect the amounts reported in our consolidated financial statements and accompanying notes. Actual results

could differ from those estimates.

Fair Value: The Fair Value Measurements and Disclosures topic of the Financial Accounting Standards

Board’s, or FASB, Accounting Standards Codification

TM

, or Codification, establishes a framework for

measuring fair value and requires enhanced disclosures about fair value measurements. Additionally, this topic

clarifies that fair value is an exit price, representing the amount that would be received to sell an asset or paid

to transfer a liability in an orderly transaction between market participants. The Fair Value Measurements and

Disclosures topic also requires disclosure about how fair value is determined for assets and liabilities and

establishes a hierarchy for which these assets and liabilities must be grouped, based on significant levels of

inputs. See Note 14 for more information.

Cash and Cash Equivalents: Our cash and cash equivalents include short-term, highly liquid

investments which are readily convertible into cash. These investments include money market securities and

commercial paper with maturities of three months or less when purchased.

Restricted Cash: Restricted cash primarily consists of security deposits and performance bonds for

aircraft and facility leases, funds held in escrow for estimated workers’ compensation obligations, and funds

held as collateral for our primary credit card processor.

Accounts and Other Receivables: Accounts and other receivables are carried at cost. They primarily

consist of amounts due from credit card companies associated with sales of tickets for future travel and

amounts due from counterparties associated with fuel derivative instruments that have settled. We estimate an

allowance for doubtful accounts based on known troubled accounts, if any, and historical experience of losses

incurred.

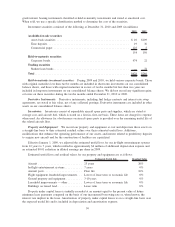

Investment Securities: Investment securities consist of the following: (a) highly liquid investments, such

as certificates of deposits, with maturities greater than three months when purchased, stated at fair value;

(b) auction rate securities, or ARS, stated at fair value; (c) variable rate demand notes with stated maturities

generally greater than ten years with interest reset dates often every 30 days or less, stated at fair value;

(d) commercial paper with maturities between six and twelve months, stated at fair value; and (e) investment-

49