JetBlue Airlines 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

terrorism. We believe the working capital available to us will be sufficient to meet our cash requirements for

at least the next 12 months.

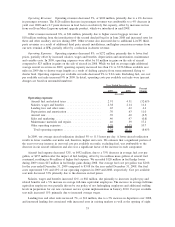

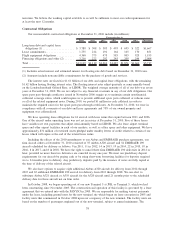

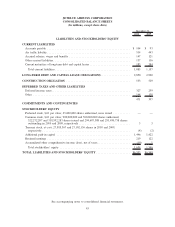

Contractual Obligations

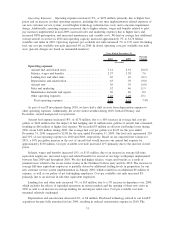

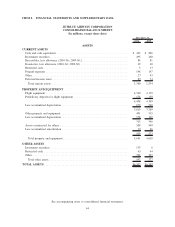

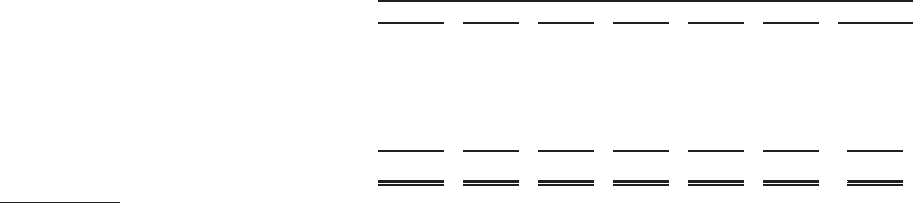

Our noncancelable contractual obligations at December 31, 2010 include (in millions):

Total 2011 2012 2013 2014 2015 Thereafter

Payments due in

Long-term debt and capital lease

obligations (1) .................... $ 3,788 $ 308 $ 303 $ 493 $ 695 $ 322 $1,667

Lease commitments .................. 1,755 214 191 164 165 170 851

Flight equipment obligations ........... 4,360 375 475 585 805 925 1,195

Financing obligations and other (2) ...... 3,216 222 292 245 209 244 2,004

Total ............................. $13,119 $1,119 $1,261 $1,487 $1,874 $1,661 $5,717

(1) Includes actual interest and estimated interest for floating-rate debt based on December 31, 2010 rates.

(2) Amounts include noncancelable commitments for the purchase of goods and services.

The interest rates are fixed for $1.61 billion of our debt and capital lease obligations, with the remaining

$1.42 billion having floating interest rates. The floating interest rates adjust quarterly or semi-annually based

on the London Interbank Offered Rate, or LIBOR. The weighted average maturity of all of our debt was seven

years at December 31, 2010. We are not subject to any financial covenants in any of our debt obligations. Our

spare parts pass-through certificates issued in November 2006 require us to maintain certain non-financial

collateral coverage ratios, which could require us to provide additional spare parts collateral or redeem some

or all of the related equipment notes. During 2010, we posted $1 million in cash collateral in order to

maintain the required ratios for the spare parts pass-through certificates. At December 31, 2010, we were in

compliance with all covenants of our debt and lease agreements and 75% of our owned property and

equipment was collateralized.

We have operating lease obligations for 61 aircraft with lease terms that expire between 2011 and 2026.

One of the aircraft under operating lease was not yet in service at December 31, 2010. Five of these leases

have variable-rate rent payments that adjust semi-annually based on LIBOR. We also lease airport terminal

space and other airport facilities in each of our markets, as well as office space and other equipment. We have

approximately $31 million of restricted assets pledged under standby letters of credit related to certain of our

leases which will expire at the end of the related lease terms.

Including the effects of the 2010 amendments to our Airbus and EMBRAER purchase agreements, our

firm aircraft orders at December 31, 2010 consisted of 55 Airbus A320 aircraft and 54 EMBRAER 190

aircraft scheduled for delivery as follows: 9 in 2011, 11 in 2012, 14 in 2013, 19 in 2014, 22 in 2015, 18 in

2016, 8 in 2017, and 8 in 2018. We have the right to cancel three firm EMBRAER 190 deliveries in 2012 or

later, provided no more than two deliveries are canceled in any one year. We meet our predelivery deposit

requirements for our aircraft by paying cash or by using short-term borrowing facilities for deposits required

six to 24 months prior to delivery. Any predelivery deposits paid by the issuance of notes are fully repaid at

the time of delivery of the related aircraft.

We also have options to acquire eight additional Airbus A320 aircraft for delivery from 2014 through

2015 and 65 additional EMBRAER 190 aircraft for delivery from 2012 through 2018. We can elect to

substitute Airbus A321 aircraft or A319 aircraft for the A320 aircraft until 21 months prior to the scheduled

delivery date for those aircraft not on firm order.

In October 2008, we began operating out of our new Terminal 5 at JFK, or Terminal 5, which we had

been constructing since November 2005. The construction and operation of this facility is governed by a lease

agreement that we entered into with the PANYNJ in 2005. We are responsible for making various payments

under the lease, including ground rents for the new terminal site which began on lease execution in 2005 and

facility rents that commenced in October 2008 upon our occupancy of the new terminal. The facility rents are

based on the number of passengers enplaned out of the new terminal, subject to annual minimums. The

38