JetBlue Airlines 2010 Annual Report Download - page 85

Download and view the complete annual report

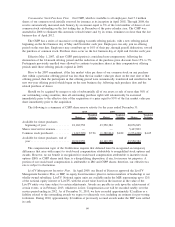

Please find page 85 of the 2010 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.settlement. As a result of our participation in this settlement agreement, UBS was required to repurchase from

us at par ARS brokered by them, which had a par value of $85 million at December 31, 2009. In July 2010,

all outstanding ARS were repurchased at par by UBS in accordance with this settlement agreement. The

proceeds were used to terminate the outstanding balance on the line of credit with UBS. As a result, we no

longer hold any trading securities as of December 31, 2010. Refer to Note 2 for further details on our

participation in UBS’s auction rate security program.

Put option related to ARS: We elected to apply the fair value option under the Financial Instruments

topic of the Codification, to UBS’s agreement to repurchase, at par, ARS brokered by them as described

above. We did so in order to closely conform to our treatment of the underlying ARS. At December 31, 2009,

the $11 million fair value of this put option was included in other current assets in our consolidated balance

sheets. The resultant loss of $3 million and gain of $14 million for 2009 and 2008, respectively, offset the

related ARS holding gains or losses included in other income (expense). The fair value of the put was

determined by comparing the fair value of the related ARS, as described above, to their par values and also

considers the credit risk associated with UBS. The fair value of the put option was based on unobservable

inputs and was therefore classified as level 3 in the hierarchy. The put option was terminated concurrent with

the sale of the underlying investments in July 2010.

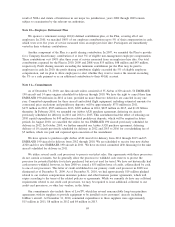

Interest rate swaps: The fair values of our interest rate swaps are based on inputs received from the

counterparty. These values were corroborated by adjusting the active swap indications in quoted markets for

similar terms (6-8 years) for the specific terms within our swap agreements. Since some of these inputs were

not observable, they are classified as level 3 inputs in the hierarchy.

Aircraft fuel derivatives: Our heating oil and jet fuel swaps, heating oil collars, and crude oil caps are

not traded on public exchanges. Their fair values are determined using a market approach based on inputs that

are readily available from public markets for commodities and energy trading activities; therefore, they are

classified as level 2 inputs. The data inputs are combined into quantitative models and processes to generate

forward curves and volatilities related to the specific terms of the underlying hedge contracts.

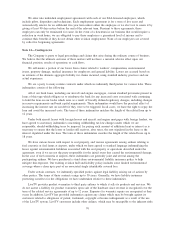

Spectrum license: In 2006, LiveTV acquired an air-to-ground spectrum license in a public auction from

the Federal Communications Commission for approximately $7 million. Since its acquisition, the license has

been treated as an indefinite lived intangible asset, reflected in other long term assets in our consolidated

balance sheets. In late 2007, we unveiled BetaBlue, an Airbus A320 aircraft, which utilized the acquired

spectrum in delivering email and internet capabilities to our customers. Since 2007, LiveTV continued to

develop this technology, with the intent of making it available on all of our aircraft. However, with the

introduction of similar service by competitors, we re-evaluated the long term viability of our planned offering

and during 2010, ceased further development of the air-to-ground platform. In September 2010, we announced

plans to develop broadband capability, partnering withViaSat and utilizing their advanced satellite

technologies. As a result of the change in plans, we evaluated the spectrum license for impairment, which

resulted in a loss of approximately $5 million being recorded in other operating expenses during 2010. We

determined the $2 million fair value of the spectrum license at December 31, 2010 using a probability

weighted cash flow model, which included an income approach for the cash flows associated with the current

general aviation business as well as a market approach based on an independent valuation. Since these inputs

are not observable, they are classified as level 3 inputs in the hierarchy.

76