JetBlue Airlines 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.27.4 million shares of our common stock. At December 31, 2010, the amount remaining in the escrow

accounts was $3 million, which is reflected as restricted cash on our consolidated balance sheets.

(9) At December 31, 2010 and 2009, four capital leased Airbus A320 aircraft are included in property and

equipment at a cost of $152 million with accumulated amortization of $18 million and $13 million,

respectively. The future minimum lease payments under these noncancelable leases are $15 million in

2011, $14 million per year in each of 2012 through 2015 and $110 million in the years thereafter.

Included in the future minimum lease payments is $53 million representing interest, resulting in a present

value of capital leases of $128 million with a current portion of $7 million and a long-term portion of

$121 million.

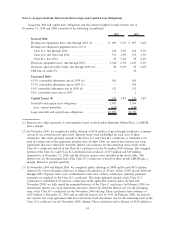

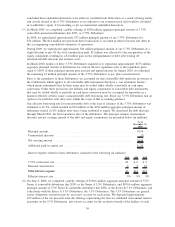

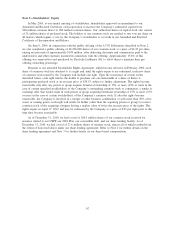

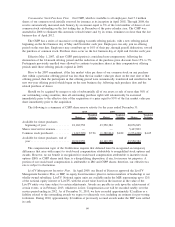

Maturities of long-term debt and capital leases, including the assumption that our convertible debt will be

redeemed upon the first put date, for the next five years are as follows (in millions):

2011 ............................................. $183

2012 ............................................. 185

2013 ............................................. 383

2014 ............................................. 603

2015 ............................................. 246

We had utilized a funding facility to finance aircraft predelivery deposits, which allowed for borrowings

of up to $30 million. In October 2009, we fully repaid the $10 million balance and terminated the funding

facility.

In July 2008, we obtained a line of credit with Citigroup Global Markets, Inc. which allowed for

borrowings of up to $110 million through July 20, 2009 and was originally secured our ARS which were then

held by Citigroup. We repaid the entire $110 million on this line of credit in October 2009 when we sold the

ARS which secured it, and concurrently terminated the facility. See Note 14 for further information.

We do not have any financial covenants associated with our debt agreements other than certain collateral

ratio requirements in our spare parts pass-through certificates and spare engine financing issued in

November 2006 and December 2007, respectively. If we fail to maintain these collateral ratios, we are

required to provide additional collateral or redeem some or all of the equipment notes so that the ratios return

to compliance. During 2010, we posted $1 million in cash collateral in order to maintain the required ratios

for the spare parts pass-through certificates.

Aircraft, engines, and other equipment and facilities having a net book value of $3.51 billion at

December 31, 2010 were pledged as security under various loan agreements. Cash payments for interest

related to debt and capital lease obligations, net of capitalized interest, aggregated $138 million, $143 million

and $166 million in 2010, 2009 and 2008, respectively.

58