JetBlue Airlines 2010 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2010 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The total intrinsic value, determined as of the date of vesting, of restricted stock units vested and

converted to shares of common stock during the twelve months ended December 31, 2010 and 2009 was

$7 million and $3 million, respectively.

During 2008, we also began issuing deferred stock units under the 2002 Plan. These awards vest

immediately upon being granted to members of the Board of Directors and shares are issued six months and

one day following the Director’s departure from the Board. During the year ended December 31, 2010, we

granted 51,975 deferred stock units at a weighted average grant date fair value of $6.06, all of which remain

outstanding at December 31, 2010.

Prior to January 1, 2006, stock options under the 2002 Plan became exercisable when vested, which

occurred in annual installments of three to seven years. For issuances under the 2002 Plan beginning in 2006,

we revised the vesting terms so that all options granted vest in equal installments over a period of three or five

years, or upon the occurrence of a change in control. All options issued under the 2002 Plan expire ten years

from the date of grant. Our policy is to grant options with an exercise price equal to the market price of the

underlying common stock on the date of grant.

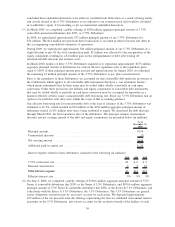

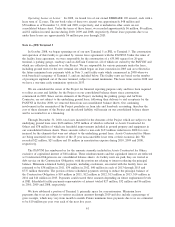

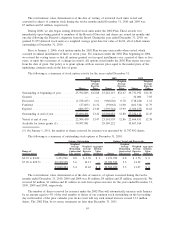

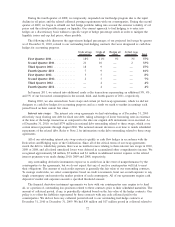

The following is a summary of stock option activity for the years ended December 31:

Shares

Weighted

Average

Exercise

Price Shares

Weighted

Average

Exercise

Price Shares

Weighted

Average

Exercise

Price

2010 2009 2008

Outstanding at beginning of year........ 25,592,883 $12.88 27,242,115 $12.47 29,731,932 $12.30

Granted .......................... — — — — 54,000 7.03

Exercised ......................... (1,158,187) 1.61 (960,626) 0.78 (718,226) 1.12

Forfeited ......................... (27,605) 11.32 (93,062) 11.00 (461,316) 11.79

Expired .......................... (806,597) 13.40 (595,544) 13.99 (1,364,275) 14.62

Outstanding at end of year ............ 23,600,494 13.42 25,592,883 12.88 27,242,115 12.47

Vested at end of year . ............... 22,504,450 13.47 23,101,559 12.86 22,464,451 12.38

Available for future grants (1) .......... 39,997,981 29,189,222 19,867,014

(1) On January 1, 2011, the number of shares reserved for issuance was increased by 11,787,492 shares.

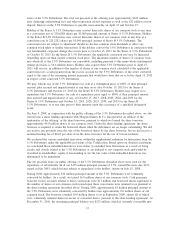

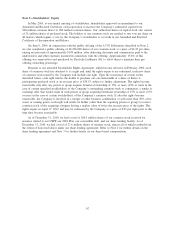

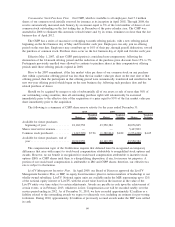

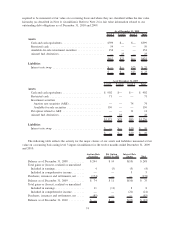

The following is a summary of outstanding stock options at December 31, 2010:

Range of

exercise prices Shares

Weighted

Average

Remaining

Contractual

Life (years)

Weighted

Average

Exercise

Price

Aggregate

Intrinsic

Value

(millions) Shares

Weighted

Average

Remaining

Contractual

Life (years)

Weighted

Average

Exercise

Price

Aggregate

Intrinsic

Value

(millions)

Options Outstanding Options Vested and Exercisable

$0.33 to $4.00 ........ 1,471,926 0.8 $ 2.76 $ 6 1,471,926 0.8 $ 2.76 $ 6

$7.03 to $29.71 ....... 22,128,568 3.6 14.13 — 21,032,524 3.5 14.22 —

23,600,494 3.4 13.42 $ 6 22,504,450 3.3 13.47 $ 6

The total intrinsic value, determined as of the date of exercise, of options exercised during the twelve

months ended December 31, 2010, 2009 and 2008 was $5 million, $4 million and $3 million, respectively. We

received $2 million, $1 million and $1 million in cash from option exercises for the years ended December 31,

2010, 2009 and 2008, respectively.

The number of shares reserved for issuance under the 2002 Plan will automatically increase each January

by an amount equal to 4% of the total number of shares of our common stock outstanding on the last trading

day in December of the prior calendar year. In no event will any such annual increase exceed 12.2 million

shares. The 2002 Plan, by its terms, terminates no later than December 31, 2011.

65