JetBlue Airlines 2010 Annual Report Download - page 46

Download and view the complete annual report

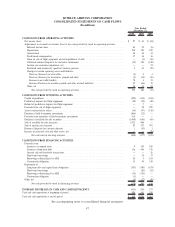

Please find page 46 of the 2010 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.spare engines, (5) the reimbursement of construction costs incurred for Terminal 5 of $15 million and (6) the

repayment of $5 million in principal related to our construction obligation for Terminal 5.

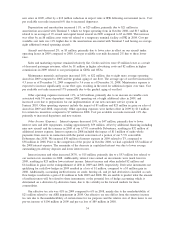

Financing activities during 2009 consisted primarily of (1) our issuance of $201 million of 6.75%

convertible debentures, raising net proceeds of approximately $197 million, (2) our public offering of

approximately 26.5 million shares of common stock for approximately $109 million in net proceeds, (3) our

issuance of $143 million in fixed rate equipment notes to banks and $102 million in floating rate equipment

notes to banks secured by three Airbus A320 and six EMBRAER 190 aircraft, (4) paying down a net of

$107 million on our lines of credit collateralized by our ARS, (5) scheduled maturities of $160 million of debt

and capital lease obligations, (6) the repurchase of $20 million principal amount of 3.75% convertible

debentures due 2035 for $20 million, and (7) the reimbursement of construction costs incurred for Terminal 5

of $49 million.

In October 2009, we filed an automatic shelf registration statement with the SEC relating to our sale,

from time to time, in one or more public offerings of debt securities, pass-through certificates, common stock,

preferred stock and/or other securities. The net proceeds of any securities we sell under this registration

statement may be used to fund working capital and capital expenditures, including the purchase of aircraft and

construction of facilities in or near airports. Through December 31, 2010, we had not issued any securities

under this registration statement. At this time, we have no plans to sell securities under this registration

statement.

None of our lenders or lessors are affiliated with us.

Capital Resources. We have been able to generate sufficient funds from operations to meet our working

capital requirements. Substantially all of our property and equipment is encumbered. We typically finance our

aircraft through either secured debt or lease financing. At December 31, 2010, we operated a fleet of 160

aircraft, of which 60 were financed under operating leases, four were financed under capital leases and all but

one of the remaining 96 were financed by secured debt. We also leased one additional aircraft which we took

delivery of in December 2010 but which was not yet placed in service. We have received committed financing

for the nine aircraft scheduled for delivery in 2011. Although we believe that debt and/or lease financing

should be available for our remaining aircraft deliveries, we cannot give assurance that we will be able to

secure financing on terms attractive to us, if at all. While these financings may or may not result in an

increase in liabilities on our balance sheet, our fixed costs will increase significantly regardless of the

financing method ultimately chosen. To the extent we cannot secure financing, we may be required to pay in

cash, further modify our aircraft acquisition plans or incur higher than anticipated financing costs.

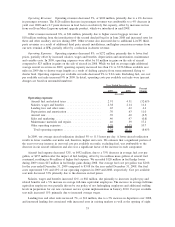

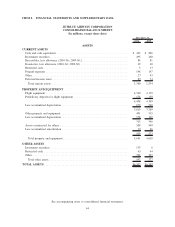

Working Capital. We had working capital of $275 million at December 31, 2010, compared to

$377 million at December 31, 2009. Our working capital includes the fair value of our short term fuel hedge

derivatives, which was an asset of $19 million and $25 million at December 31, 2010 and December 31, 2009,

respectively.

At December 31, 2008, we had $244 million invested in ARS, which were included in long-term

investments. Beginning in February 2008, all of the ARS then held by us experienced failed auctions which

resulted in us continuing to hold these securities beyond the initial auction reset periods. Auction failures

continued for some time and there was a general lack of liquidity in the market. As a result, we participated in

settlement agreements with UBS, whereby they repurchased all of the ARS brokered by them beginning in

June 2010 at par value. Additionally, in October 2009, we entered into an agreement with Citigroup Global

Markets, Inc, whereby they repurchased all of our then outstanding ARS issued by them for approximately

$120 million. As of December 31, 2010, we no longer hold any ARS.

We expect to meet our obligations as they become due through available cash, investment securities and

internally generated funds, supplemented as necessary by financing activities, as they may be available to us.

We expect to continue to generate positive working capital through our operations. However, we cannot

predict what the effect on our business might be from the extremely competitive environment we are operating

in or from events that are beyond our control, such as volatile fuel prices, economic conditions, weather-

related disruptions, the impact of airline bankruptcies and/or consolidations, U.S. military actions or acts of

37