JetBlue Airlines 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

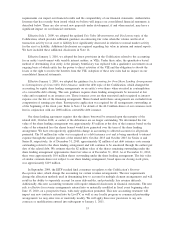

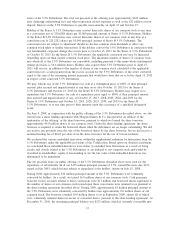

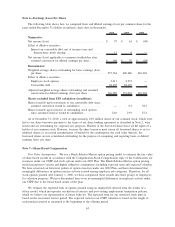

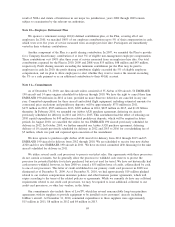

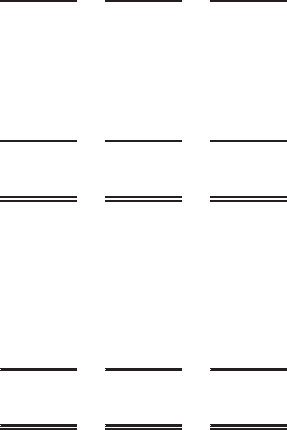

Note 6—Earnings (Loss) Per Share

The following table shows how we computed basic and diluted earnings (loss) per common share for the

years ended December 31 (dollars in millions; share data in thousands):

2010 2009 2008

Numerator:

Net income (loss) ................................... $ 97 $ 61 $ (84)

Effect of dilutive securities:

Interest on convertible debt, net of income taxes and

discretionary profit sharing ........................ 11 9 —

Net income (loss) applicable to common stockholders after

assumed conversion for diluted earnings per share ......... $ 108 $ 70 $ (84)

Denominator:

Weighted-average shares outstanding for basic earnings (loss)

per share ....................................... 275,364 260,486 226,262

Effect of dilutive securities:

Employee stock options ............................ 2,611 2,972 —

Convertible debt .................................. 68,605 68,605 —

Adjusted weighted-average shares outstanding and assumed

conversions for diluted earnings (loss) per share . ......... 346,580 332,063 226,262

Shares excluded from EPS calculation (in millions):

Shares issuable upon conversion of our convertible debt since

assumed conversion would be antidilutive ............... — 9.2 38.3

Shares issuable upon exercise of outstanding stock options

since assumed exercise would be antidilutive ............. 24.0 23.9 27.2

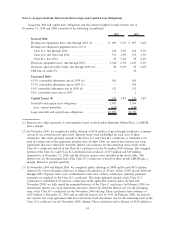

As of December 31, 2010, a total of approximately 18.0 million shares of our common stock, which were

lent to our share borrower pursuant to the terms of our share lending agreement as described in Note 2, were

issued and are outstanding for corporate law purposes. Holders of the borrowed shares have all the rights of a

holder of our common stock. However, because the share borrower must return all borrowed shares to us (or

identical shares or, in certain circumstances of default by the counterparty, the cash value thereof), the

borrowed shares are not considered outstanding for the purpose of computing and reporting basic or diluted

earnings (loss) per share.

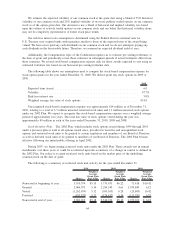

Note 7—Share-Based Compensation

Fair Value Assumptions: We use a Black-Scholes-Merton option pricing model to estimate the fair value

of share-based awards in accordance with the Compensation-Stock Compensation topic of the Codification, for

issuances under our CSPP and stock options under our 2002 Plan. The Black-Scholes-Merton option pricing

model incorporates various and highly subjective assumptions, including expected term and expected volatility.

We have reviewed our historical pattern of option exercises under our 2002 Plan, and have determined that

meaningful differences in option exercise activity existed among employee job categories. Therefore, for all

stock options granted after January 1, 2006, we have categorized these awards into three groups of employees

for valuation purposes. We have determined there were no meaningful differences in employee activity under

our CSPP due to the broad-based nature of the plan.

We estimate the expected term of options granted using an implied life derived from the results of a

lattice model, which incorporates our historical exercise and post-vesting employment termination patterns,

which we believe are representative of future behavior. The expected term for our restricted stock units is

based on the associated service period. The expected term for our CSPP valuation is based on the length of

each purchase period as measured at the beginning of the offering period.

63