JetBlue Airlines 2010 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2010 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

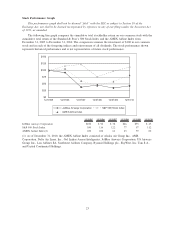

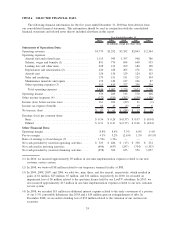

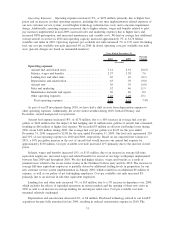

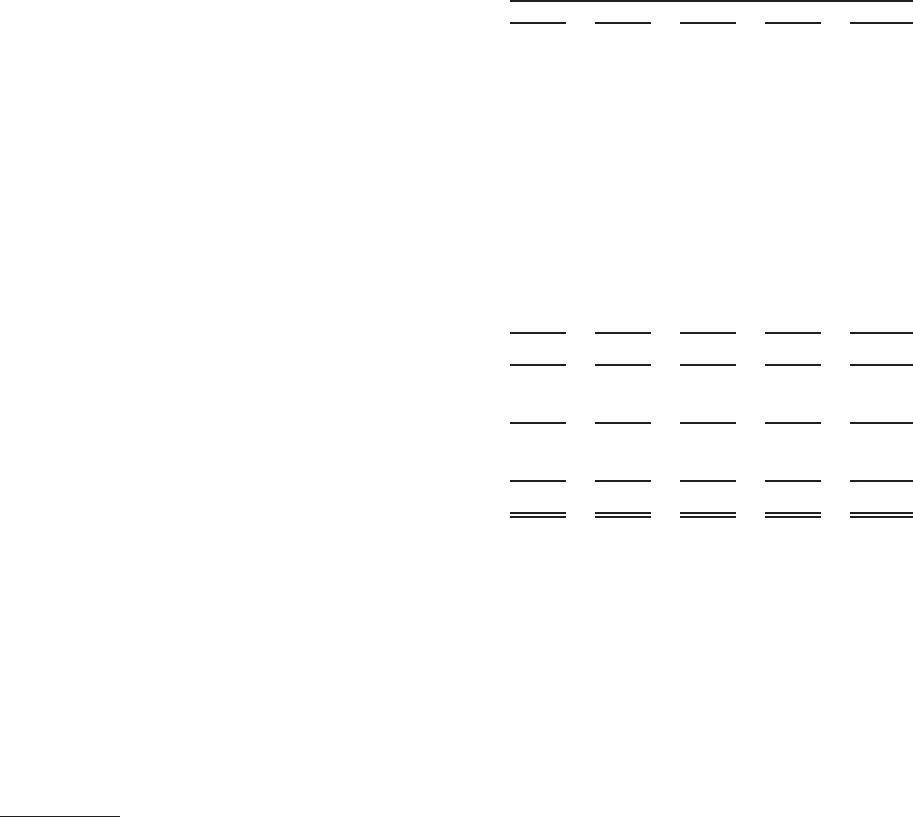

ITEM 6. SELECTED FINANCIAL DATA

The following financial information for the five years ended December 31, 2010 has been derived from

our consolidated financial statements. This information should be read in conjunction with the consolidated

financial statements and related notes thereto included elsewhere in this report.

2010 2009 2008 2007 2006

Year Ended December 31,

(in millions, except per share data)

Statements of Operations Data:

Operating revenues ............................ $3,779 $3,292 $3,392 $2,843 $ 2,364

Operating expenses:

Aircraft fuel and related taxes ................... 1,115 945 1,397 968 786

Salaries, wages and benefits (1) ................. 891 776 694 648 553

Landing fees and other rents .................... 228 213 199 180 158

Depreciation and amortization (2) ................ 220 228 205 176 151

Aircraft rent ................................ 126 126 129 124 103

Sales and marketing .......................... 179 151 151 121 104

Maintenance materials and repairs ............... 172 149 127 106 87

Other operating expenses (3) ................... 515 419 377 350 294

Total operating expenses ..................... 3,446 3,007 3,279 2,673 2,236

Operating income . ............................ 333 285 113 170 128

Other income (expense) (4) ...................... (172) (181) (202) (139) (129)

Income (loss) before income taxes ................. 161 104 (89) 31 (1)

Income tax expense (benefit) ..................... 64 43 (5) 19 6

Net income (loss) . ............................ $ 97 $ 61 $ (84) $ 12 $ (7)

Earnings (loss) per common share:

Basic ..................................... $ 0.36 $ 0.24 $ (0.37) $ 0.07 $ (0.04)

Diluted ................................... $ 0.31 $ 0.21 $ (0.37) $ 0.06 $ (0.04)

Other Financial Data:

Operating margin . . ............................ 8.8% 8.6% 3.3% 6.0% 5.4%

Pre-tax margin ................................ 4.3% 3.2% (2.6)% 1.1% (0.1)%

Ratio of earnings to fixed charges (5) ............... 1.59x 1.33x — — —

Net cash provided by (used in) operating activities ..... $ 523 $ 486 $ (17) $ 358 $ 274

Net cash used in investing activities ................ (696) (457) (247) (734) (1,307)

Net cash provided by (used in) financing activities ..... (258) 306 635 556 1,037

(1) In 2010, we incurred approximately $9 million in one-time implementation expenses related to our new

customer service system.

(2) In 2008, we wrote-off $8 million related to our temporary terminal facility at JFK.

(3) In 2009, 2008, 2007, and 2006, we sold two, nine, three, and five aircraft, respectively, which resulted in

gains of $1 million, $23 million, $7 million, and $12 million, respectively. In 2010, we recorded an

impairment loss of $6 million related to the spectrum license held by our LiveTV subsidiary. In 2010, we

also incurred approximately $13 million in one-time implementation expenses related to our new customer

service system.

(4) In 2008, we recorded $13 million in additional interest expense related to the early conversion of a portion

of our 5.5% convertible debentures due 2038 and a $14 million gain on extinguishment of debt. In

December 2008, we recorded a holding loss of $53 million related to the valuation of our auction rate

securities.

24