JetBlue Airlines 2010 Annual Report Download - page 62

Download and view the complete annual report

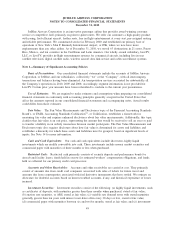

Please find page 62 of the 2010 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.requirements can impact our financial results and the comparability of our financial statements. Authoritative

literature that has recently been issued which we believe will impact our consolidated financial statements is

described below. There are also several new proposals under development, if and when enacted, may have a

significant impact on our financial statements.

Effective July 1, 2009, we adopted the updated Fair Value Measurements and Disclosures topic of the

Codification, which provides additional guidance on estimating fair value when the volume and level of

transaction activity for an asset or liability have significantly decreased in relation to normal market activity

for the asset or liability. Additional disclosures are required regarding fair value in interim and annual reports.

We have included these additional disclosures in Note 14.

Effective January 1, 2010, we adopted the latest provisions in the Codification related to the accounting

for an entity’s involvement with variable interest entities, or VIEs. Under these rules, the quantitative based

method of determining if an entity is the primary beneficiary was replaced with a qualitative assessment on an

ongoing basis of which entity has the power to direct activities of the VIE and the obligation to absorb the

losses or the right to receive the benefits from the VIE. Adoption of these new rules had no impact on our

consolidated financial statements.

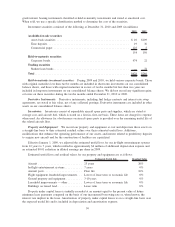

Effective January 1, 2010, we adopted the guidance for Accounting for Own-Share Lending Arrangements

in Contemplation of Convertible Debt Issuance, under the debt topic of the Codification, which changed the

accounting for equity share lending arrangements on an entity’s own shares when executed in contemplation

of a convertible debt offering. This new guidance requires share lending arrangements be measured at fair

value and recognized as an issuance cost. These issuance costs are then amortized and recognized as interest

expense over the life of the financing arrangement. Shares loaned under these arrangements are excluded from

computation of earnings per share. Retrospective application was required for all arrangements outstanding as

of the beginning of the fiscal year. Refer to Note 2 for details of the 44.9 million shares of our common stock

lent in conjunction with our 2008 million convertible debt issuance.

Our share lending agreement requires that the shares borrowed be returned upon the maturity of the

related debt, October 2038, or earlier, if the debentures are no longer outstanding. We determined the fair

value of the share lending arrangement was approximately $5 million at the date of the issuance based on the

value of the estimated fees the shares loaned would have generated over the term of the share lending

arrangement. We have retrospectively applied this change in accounting to affected accounts for all periods

presented. The $5 million fair value was recognized as a debt issuance cost and is being amortized to interest

expense through the earliest put date of the related debt, October 2013 and October 2015 for Series A and

Series B, respectively. As of December 31, 2010, approximately $2 million of net debt issuance costs remain

outstanding related to the share lending arrangement and will continue to be amortized through the earliest put

date of the related debt. We estimate that the $2 million value of the shares remaining outstanding under the

share lending arrangement approximates their fair value as of December 31, 2010. As of December 31, 2010,

there were approximately 18.0 million shares outstanding under the share lending arrangement. The fair value

of similar common shares not subject to our share lending arrangement, based upon our closing stock price,

was approximately $119 million.

In September 2009, the EITF reached final consensus on updates to the Codification’s Revenue

Recognition rules, which change the accounting for certain revenue arrangements. The new requirements

change the allocation methods used in determining how to account for multiple element arrangements and will

result in the ability to separately account for more deliverables, and potentially less revenue deferrals.

Additionally, this new accounting treatment will require enhanced disclosures in financial statements. The new

rule is effective for revenue arrangements entered into or materially modified in fiscal years beginning after

June 15, 2010, on a prospective basis, with early application permitted. This new accounting treatment will

impact any new contracts entered into by LiveTV, as well as any loyalty program or commercial partnership

arrangements we may enter into or materially modify. We will apply these new provisions to any new

contracts or modifications entered into subsequent to January 1, 2011.

53