JetBlue Airlines 2010 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2010 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

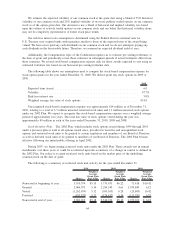

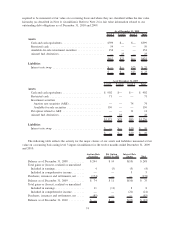

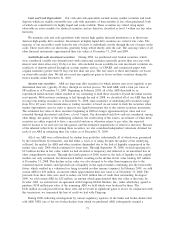

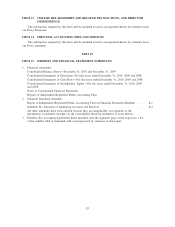

required to be measured at fair value on a recurring basis and where they are classified within the fair value

hierarchy (as described in Note 1) (in millions). Refer to Note 2 for fair value information related to our

outstanding debt obligations as of December 31, 2010 and 2009.

Level 1 Level 2 Level 3 Total

As of December 31, 2010

Assets

Cash and cash equivalents ........................... $399 $— $— $399

Restricted cash ................................... 59 — — 59

Available-for-sale investment securities . ................ 154 — — 154

Aircraft fuel derivatives ............................. — 23 — 23

$612 $23 $— $635

Liabilities

Interest rate swap ................................. $ — $— $23 $ 23

$ — $— $23 $ 23

Level 1 Level 2 Level 3 Total

As of December 31, 2009

Assets

Cash and cash equivalents ......................... $ 902 $— $— $ 902

Restricted cash ................................. 71 — — 71

Investment securities

Auction rate securities (ARS) ..................... — — 74 74

Available-for-sale securities ...................... 150 — — 150

Put option related to ARS ......................... — — 11 11

Aircraft fuel derivatives ........................... — 28 — 28

$1,123 $28 $85 $1,236

Liabilities

Interest rate swap ............................... $ — $— $10 $ 10

$ — $— $10 $ 10

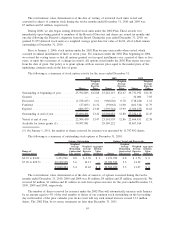

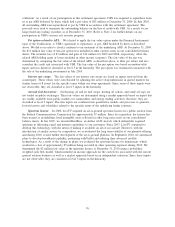

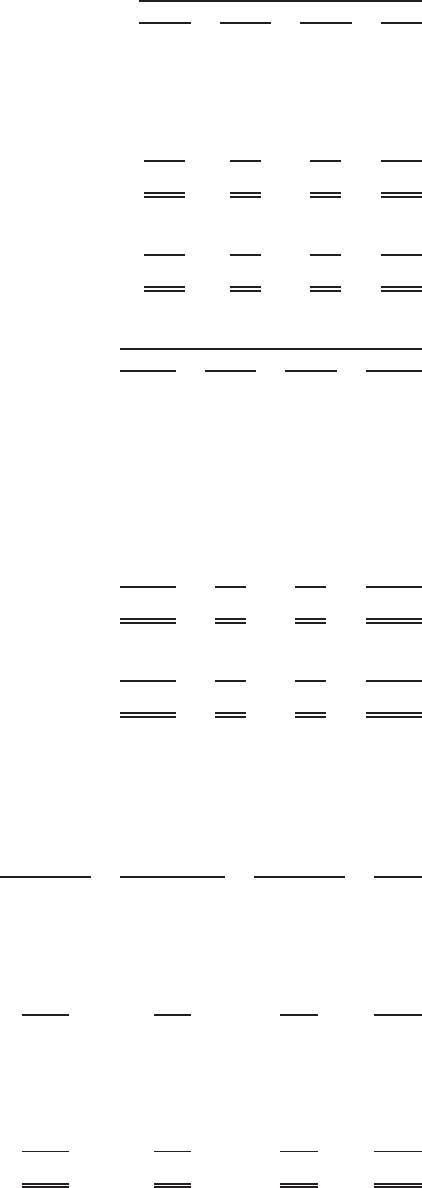

The following table reflects the activity for the major classes of our assets and liabilities measured at fair

value on a recurring basis using level 3 inputs (in millions) for the twelve months ended December 31, 2009

and 2010:

Auction Rate

Securities

Put Option

related to ARS

Interest Rate

Swaps Total

Balance as of December 31, 2008 .......... $244 $14 $(10) $ 248

Total gains or (losses), realized or unrealized

Included in earnings................... 4 (3) (5) (4)

Included in comprehensive income ........ — — 5 5

Purchases, issuances and settlements, net ..... (174) — — (174)

Balance as of December 31, 2009 .......... $ 74 $11 $(10) $ 75

Total gains or (losses), realized or unrealized

Included in earnings................... 11 (11) 8 8

Included in comprehensive income ........ — — (21) (21)

Purchases, issuances and settlements, net ..... (85) — — (85)

Balance as of December 31, 2010 .......... $ — $— $(23) $ (23)

74