JetBlue Airlines 2010 Annual Report Download - page 41

Download and view the complete annual report

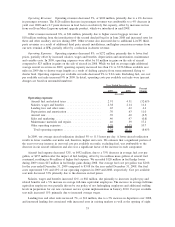

Please find page 41 of the 2010 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.reduced amortization expense was offset by an increase in depreciation expense as we had an average of 97

owned and capital leased aircraft in 2010 compared to 93 in 2009. Additionally, we had increased software

amortization in 2010 related to our new customer service system. Cost per available seat mile decreased 10%

due to purchased technology becoming fully amortized and less owned computer hardware resulting from

changes to our IT infrastructure.

Sales and marketing expense increased 19%, or $28 million, due to $14 million in higher credit card fees

resulting from increased average fares, $12 million in higher commissions in 2010 related to our increased

participation in GDSs and OTAs and $2 million in higher advertising costs. Cost per available seat mile

increased 12% due to increased fares and shift in distribution channels as a result of our increased capabilities

from our new customer service system.

Maintenance materials and repairs increased 15%, or $23 million, due to five additional average operating

aircraft in 2010 compared to 2009 and the gradual aging of our fleet. The average age of our fleet increased to

5.4 years as of December 31, 2010 compared to 4.3 years as of December 31, 2009. Maintenance expense is

expected to increase significantly as our fleet ages, resulting in the need for additional, more expensive repairs

over time. Cost per available seat mile increased 8% primarily due to the gradual aging of our fleet.

Other operating expenses increased 23%, or $96 million, due to an increase in variable costs associated

with 5% more departures versus 2009, operating out of three additional cities in 2010 in addition to the full

year of operations at the eight cities opened throughout 2009, and a severe winter storm season in early 2010.

We also incurred approximately $13 million in one time implementation expenses related to our new customer

service system, as well as overall higher technology infrastructure related costs. Additionally, we incurred a

$6 million one time impairment expense related to the intangible assets and other costs associated with

developing an air to ground connectivity capability by our LiveTV subsidiary. In 2010, we also paid a

$5 million rescheduling fee in connection with the deferral of aircraft. In 2009, other operating expenses were

offset by $11 million for certain tax incentives and $1 million in gains on sales of aircraft. Cost per available

seat mile increased 15% due primarily to the implementation costs associated with our new customer service

system, changes in our IT infrastructure and the 2009 tax incentive credits.

Other Income (Expense). Interest expense decreased 9%, or $18 million, primarily due to lower debt

balances and changes in interest rates, totaling approximately $14 million, and retirements of debt which

resulted in approximately $14 million less interest expense. These decreases in interest expense were offset by

additional financing including four new aircraft and the issuance in June 2009 of our 6.75% convertible

debentures, resulting in $11 million of additional interest expense. Capitalized interest decreased due to lower

average outstanding pre-delivery deposits and lower interest rates.

Interest income and other decreased 62%, or $6 million, primarily due to lower interest rates earned on

investments. Interest income and other included $2 million in gains on the extinguishment of debt in 2009.

Derivative instruments not qualifying as cash flow hedges in 2010 resulted in an insignificant loss, compared

to losses of $1 million in 2009. Accounting ineffectiveness on crude, heating oil and jet fuel derivatives

classified as cash flow hedges resulted in losses of $2 million in 2010 and gains of $1 million in 2009. We are

unable to predict what the amount of ineffectiveness will be related to these instruments, or the potential loss

of hedge accounting which is determined on a derivative-by-derivative basis, due to the volatility in the

forward markets for these commodities.

Our effective tax rate was 40% in 2010 compared to 41% in 2009. Our effective tax rate differs from the

statutory income tax rate due to the non deductibility of certain items for tax purposes and the relative size of

these items to our pre-tax income of $161 million in 2010 and pre-tax income of $104 million in 2009.

Year 2009 Compared to Year 2008

We reported net income of $61 million in 2009 compared to a net loss of $84 million in 2008. In 2009,

we had operating income of $285 million, an increase of $172 million over 2008, and an operating margin of

8.6% up 5.3 points from 2008. Diluted earnings per share were $0.21 for 2009 compared to diluted loss per

share of $0.37 for 2008.

32