IBM 1997 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 1997 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76

notes to consolidated financial statements

International Business Machines Corporation

and Subsidiary Companies

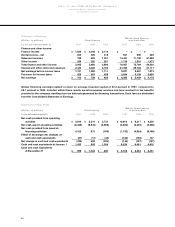

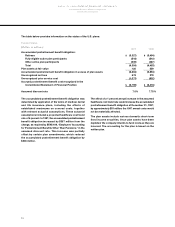

Z Geographic Areas

The United States and Canada are managed as a single

enterprise. However, in compliance with SFAS 14,

“Financial Reporting for Segments of a Business

Enterprise,” the United States is reported as a separate

geographic area. Canadian operations are included in the

“Americas” area.

Non-U.S. subsidiaries operating in local currency

environments account for approximately 81 percent

of the company’s non-U.S. revenue. The remaining

19 percent is from subsidiaries and branches operating

in U.S. dollars or in highly inflationary environments.

In the Europe/Middle East/Africa area, European oper-

ations accounted for approximately 95 percent of revenue

in 1997, 1996 and 1995.

Interarea transfers consist principally of completed

machines, subassemblies and parts, and software.

Machines and subassemblies and parts are generally

transferred at an intracompany selling price. Software

transfers represent license fees paid by non-U.S.

subsidiaries. The intracompany selling price that relates

to fixed asset transfers is capitalized and depre-

ciated by the importing area.