IBM 1997 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 1997 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

notes to consolidated financial statements

International Business Machines Corporation

and Subsidiary Companies

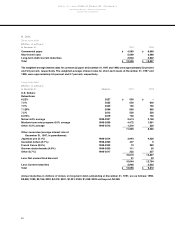

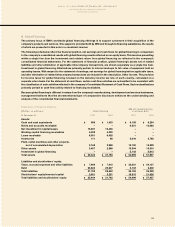

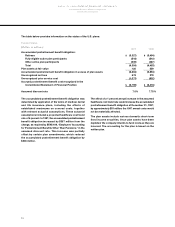

R Net Earnings Per Share of Common Stock

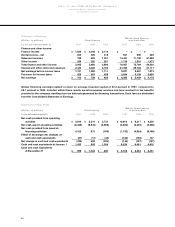

The following table sets forth the computation of basic and diluted earnings per share.

For the year ended December 31: 1997 1996 1995 1994 1993

Number of shares on which basic

earnings per share is calculated:

Average outstanding during year 983,286,361 1,056,704,188 1,138,768,058 1,169,917,398 1,146,478,480

Add – Incremental shares under

stock compensation plans 27,648,581 23,004,716 18,446,278 8,616,538 –

– Incremental shares related

to 5.75% convertible

bonds (average) – – 10,582,196 15,430,782 –

________________________ ________________________ ________________________ ________________________ ________________________

Number of shares on which diluted

earnings per share is calculated 1,010,934,942 1,079,708,904 1,167,796,532 1,193,964,718 1,146,478,480

Net earnings (loss)

applicable to common

shareholders (millions) $6,073 $5,409 $4,116 $2,937 $(8,148)

Net earnings effect

of interest on 5.75%

convertible bonds (millions) – – 1 19 –

Net earnings (loss) on which

diluted earnings per share

is calculated (millions) $6,073 $5,409 $4,117 $2,956 $(8,148)

Basic earnings (loss) per share $6.18 $5.12 $3.61 $2.51 $(7.11)

Diluted earnings (loss) per share $6.01 $5.01 $3.53 $2.48 $(7.11)

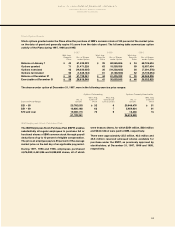

Stock options to purchase 165,833 shares in 1997, 784,141 shares in 1996, 10,304,286 shares in 1995 and 14,531,336 shares

in 1994 were outstanding, but were not included in the computation of diluted earnings per share because the options’

exercise price was greater than the average market price of the common shares, and therefore, the effect would be

antidilutive. In 1993, the incremental shares under stock plans (58,971,448 shares) and the effect of the convertible

bonds (15,430,800 shares) were not considered for the diluted earnings per share calculation due to their antidilutive effect.

As such, the amounts reported for basic and diluted earnings per share are the same.