IBM 1997 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 1997 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ASignificant Accounting Policies

Principles of Consolidation

The consolidated financial statements include the

accounts of International Business Machines Corporation

and its controlled subsidiary companies, which are

generally majority owned. Investments in business enti-

ties in which IBM does not have control, but has the ability

to exercise significant influence over operating and

financial policies (generally 20-50 percent ownership),

are accounted for by the equity method. Other invest-

ments are accounted for by the cost method.

Use of Estimates

The preparation of financial statements in conformity

with generally accepted accounting principles requires

management to make estimates and assumptions that

affect the amounts reported in the consolidated financial

statements and accompanying disclosures. Although

these estimates are based on management’s best

knowledge of current events and actions the company

may undertake in the future, actual results ultimately

may differ from the estimates.

Revenue

Revenue from hardware sales or sales-type leases is

recognized when the product is shipped. Revenue from

one-time-charge licensed software is recognized when

the program is shipped with a deferral for post-contract

customer support. This deferral is earned over the support

period. Revenue from monthly software licenses is

recognized as license fees accrue; from maintenance

and services over the contractual period or as the services

are performed; from rentals and operating leases, monthly

as the fees accrue; and from financing at level rates of

return over the term of the lease or receivable. Revenue is

reduced for estimated customer returns and allowances.

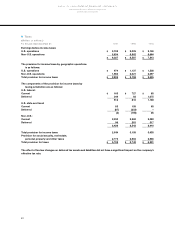

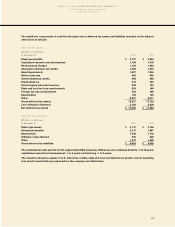

Income Taxes

Income tax expense is based on reported earnings before

income taxes. Deferred income taxes reflect the impact

of temporary differences between assets and liabilities

recognized for financial reporting purposes and such

amounts recognized for income tax purposes. In

accordance with Statement of Financial Accounting

Standards (SFAS) 109, “Accounting for Income Taxes,”

these deferred taxes are measured by applying currently

enacted tax laws.

Translation of Non-U.S. Currency Amounts

Assets and liabilities of non-U.S. subsidiaries that operate

in a local currency environment are translated to U.S.

dollars at year-end exchange rates. Income and expense

items are translated at average rates of exchange prevailing

during the year. Translation adjustments are accumulated

in a separate component of stockholders’ equity.

Inventories and plant, rental machines and other non-

monetary assets and liabilities of non-U.S. subsidiaries

and branches that operate in U.S. dollars, or whose

economic environment is highly inflationary, are translated

at approximate exchange rates prevailing when acquired.

All other assets and liabilities are translated at year-end

exchange rates. Inventories charged to cost of sales and

depreciation are translated at historical exchange rates.

All other income and expense items are translated at

average rates of exchange prevailing during the year.

Gains and losses that result from translation are included

in earnings.

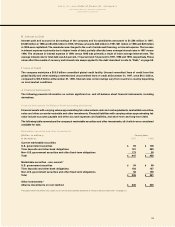

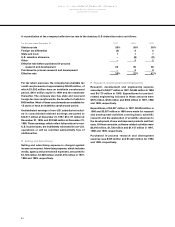

Financial Instruments

In the normal course of business, the company uses a

variety of derivative financial instruments for the purpose

of currency exchange rate and interest rate risk

management. Refer to note J, “Financial Instruments,”

on pages 59 through 61 for descriptions of these financial

instruments, including the methods used to account

for them.

In assessing the fair value of its financial instruments,

both derivative and non-derivative, the company uses

a variety of methods and assumptions that are based

on market conditions and risks existing at each balance

sheet date. Quoted market prices or dealer quotes for the

same or similar instruments are used for the majority of

marketable securities, long-term investments and long-

term debt. Other techniques, such as option pricing

models, estimated discounted value of future cash flows,

replacement cost and termination cost, are used to

determine fair value for the remaining financial

instruments. These values represent a general approx-

imation of possible value and may never actually be

realized.

notes to consolidated financial statements

International Business Machines Corporation

and Subsidiary Companies

54