IBM 1997 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 1997 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

management discussion

International Business Machines Corporation

and Subsidiary Companies

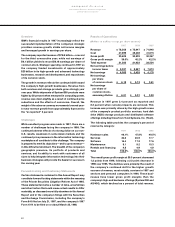

Operating Expenses

(Dollars in millions)

1997 1996 1995

Selling, general and

administrative $16,634 $16,854 $16,766

Percentage of revenue 21.2% 22.2% 23.3%

Research, development

and engineering $4,877 $4,654 $4,170

Percentage of revenue 6.2% 6.1% 5.8%

Purchased in-process

research and

development $–$435 $1,840

Selling, general and administrative (SG&A) expense

declined 1.3 percent in 1997 versus 1996 and remained

essentially flat in 1996 compared to 1995. The company

continued its focus on reducing fixed infrastructure costs,

while increasing its investments in advertising, business

partner programs and emerging markets. These actions

yielded a 1.0 percentage point improvement in the

expense-to-revenue ratio in 1997 and a 1.1 percentage

point improvement in 1996.

The company continues to focus on productivity, expense

controls and prioritization of spending in order to achieve

a more competitive expense-to-revenue level.

Research, development and engineering expense

increased 4.8 percent in 1997 from 1996, following an

increase of 11.6 percent in 1996 from 1995. The increases

reflect the company’s continued investments in high-

growth opportunities like Java, network computing and

e-business, as well as the impact of additional expenses

associated with new acquisitions. Also, ongoing activities

of Lotus and Tivoli are included in 1996 and 1997 results,

as compared to 1995, which only included Lotus activity

between July and December 1995.

The benefits of the company’s ongoing research and

development have resulted in the company being granted

1,724 patents in 1997, placing it number one in the U.S.

for the fifth consecutive year. The application of these

technological advances has enabled the company to

transform this research and development into several

significant new product breakthroughs that will be found

in products beginning in 1998. Examples of these efforts

are the use of copper in place of aluminum in the making

of integrated circuits and the manufacturing of HDDs

using giant magnetoresistive head technology that

delivers a maximum areal density of about 2.6 billion bits

per square inch.

Purchased in-process research and development expense

in 1996 and 1995 was primarily associated with the Tivoli

and Lotus acquisitions, respectively.

On a constant currency basis, SG&A expense would have

increased approximately 2.7 percent in 1997 versus 1996,

and research, development and engineering expense

would have increased approximately 5.9 percent.

Provision for Income Taxes

The provision for income taxes resulted in an effective

tax rate of 33 percent for 1997, as compared to the 1996

effective tax rate of 37 percent and a 1995 effective tax rate

of 47 percent. Adjusting for purchased in-process research

and development which had no corresponding tax effect,

the 1996 and 1995 effective tax rates would have been

35 percent and 38 percent, respectively. The reduction in

the 1997 tax rate reflects the company’s continued

expansion into markets with lower effective tax rates.

The reduction in the 1996 tax rate was also due to the

company’s continued expansion into markets with lower

effective tax rates, as well as the use of foreign tax credits

to offset the tax effect of dividend repatriation from non-

U.S. affiliates.

The company accounts for income taxes under Statement

of Financial Accounting Standards (SFAS) 109, “Accounting

for Income Taxes,” which provides that a valuation

allowance should be recognized to reduce the deferred

tax asset to the amount that is more likely than not to be

realized. In assessing the likelihood of realization,

management considered estimates of future taxable

income, which are based primarily on recent financial

performance.

Fourth Quarter

For the quarter ended December 31, 1997, the company

had revenue of $23.7 billion, a 2.5 percent increase over

the same period of 1996. Net earnings in the fourth quarter

were $2,093 million ($2.16 per common share), compared

with net earnings of $2,023 million ($1.97 per common

share) in the fourth quarter of 1996.

Fourth-quarter revenue from the United States was

$9.5 billion, an increase of 8.9 percent from the same

period of 1996. Asia Pacific revenue was essentially flat

at $4.4 billion, while revenue from the company’s Europe,

Middle East and Africa units declined 4.4 percent to

$7.7 billion. Revenue in Latin America was $1.2 billion,

an increase of 4.4 percent and revenue from Canada

increased 14.2 percent to $.9 billion.

43