IBM 1997 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 1997 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

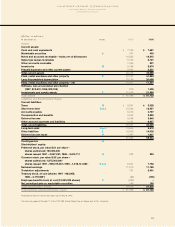

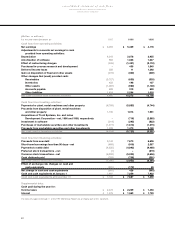

notes to consolidated financial statements

International Business Machines Corporation

and Subsidiary Companies

61

For purchased options that hedge anticipated trans-

actions, gains and losses are deferred and recognized

in other income in the same period that the underlying

transaction occurs, expires or is otherwise terminated. At

December 31, 1997 and 1996, there were no material

deferred gains or losses. The premiums associated with

entering into option contracts are generally amortized

over the life of the options and are not material to the

company’s results. Unamortized premiums are included

in prepaid assets. All written options are marked to market

monthly and are not material to the company’s results.

The company also enters into derivative transactions to

moderate the impact that an appreciation of the dollar

relative to other currencies would have on the translation

of foreign earnings. These transactions do not qualify as

hedges for accounting purposes, and their foreign

exchange gains and losses are recorded in earnings as

they occur.

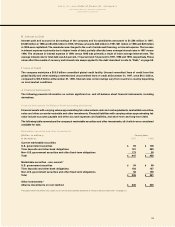

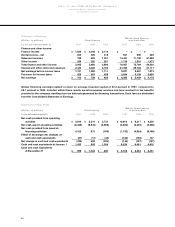

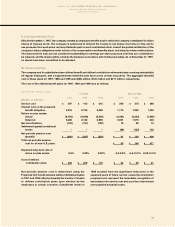

KSale and Securitization of Receivables

At year-end 1997, the company had a net balance of

$.9 billion in assets under management from the

securitization of loans, leases and trade receivables,

compared to $1.1 billion at year-end 1996. The company

received total cash proceeds of approximately $3.0 billion

and $4.0 billion in 1997 and 1996, respectively, from the

sale and securitization of these receivables and assets.

No material gain or loss resulted from these transactions.

Recourse amounts associated with the aforementioned

sales and securitization activities are expected to be

minimal, and adequate reserves are in place to cover

potential losses.

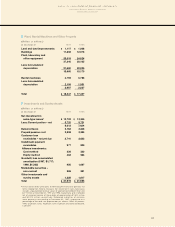

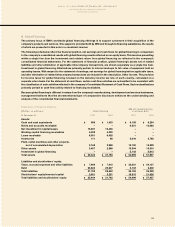

LOther Liabilities and Environmental

Other liabilities consists principally of accruals for

nonpension postretirement benefits for U.S. employees

($6.8 billion) and indemnity and retirement plan reserves

for non-U.S. employees ($1.3 billion). More detailed

discussion of these liabilities appears in note X,

“Nonpension Postretirement Benefits,” on pages 73 and

74, and note W, “Retirement Plans,” on pages 71 through

73. In addition, noncurrent liabilities associated with

prior infrastructure reduction actions amounted to

$1.8 billion at December 31, 1997.

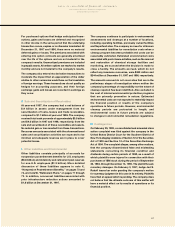

The company continues to participate in environmental

assessments and cleanups at a number of locations,

including operating facilities, previously owned facilities

and Superfund sites. The company accrues for all known

environmental liabilities for remediation costs when a

cleanup program becomes probable and costs can be

reasonably estimated. Estimated environmental costs

associated with post-closure activities, such as the removal

and restoration of chemical storage facilities and

monitoring, are accrued when the decision is made to

close a facility. The amounts accrued, which do not

reflect any insurance recoveries, were $243 million and

$244 million at December 31, 1997 and 1996, respectively.

The amounts accrued do not cover sites that are in the

preliminary stages of investigation where neither the

company’s percentage of responsibility nor the extent of

cleanup required has been identified. Also excluded is

the cost of internal environmental protection programs

that are primarily preventive in nature. Estimated

environmental costs are not expected to materially impact

the financial position or results of the company’s

operations in future periods. However, environmental

cleanup periods are protracted in length, and

environmental costs in future periods are subject

to changes in environmental remediation regulations.

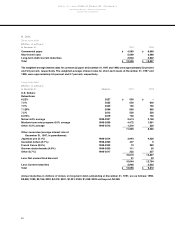

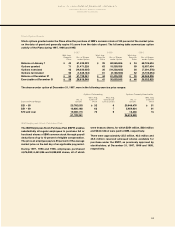

MContingencies

On February 25, 1993, a consolidated and amended class

action complaint was filed against the company in the

United States District Court for the Southern District of

New York alleging violations of Section 12 of the Securities

Act of 1933 and Section 10 of the Securities Exchange

Act of 1934. The complaint alleges, among other matters,

that the company disseminated false and misleading

statements concerning its financial condition and

dividends during certain periods of 1992, as a result of

which plaintiffs were injured in connection with their

purchases of IBM stock during the period of September

30, 1992, through December 14, 1992. The plaintiffs seek

monetary damages. On February 3, 1997, Judge Jed S.

Rakoff issued an order granting the company’s motion

for summary judgment in this case in its entirety. Plaintiffs

have filed an appeal which is pending. The company does

not believe that the ultimate outcome of this matter will

have a material effect on its results of operations or its

financial position.