IBM 1997 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 1997 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

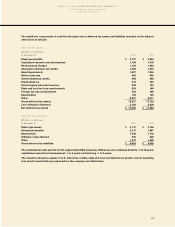

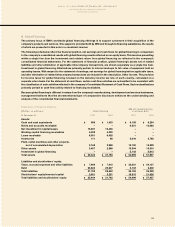

notes to consolidated financial statements

International Business Machines Corporation

and Subsidiary Companies

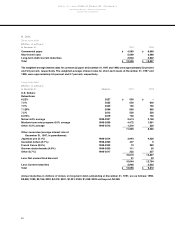

Cash Equivalents

All highly liquid investments with a maturity of three

months or less at date of purchase are carried at fair

value and considered to be cash equivalents.

Inventories

Raw materials, work in process and finished goods are

stated at the lower of average cost or market.

Depreciation

Plant, rental machines and other property are carried at

cost, and depreciated over their estimated useful lives

using the straight-line method.

Software

Costs related to the conceptual formulation and design

of licensed programs are expensed as research and

development. Costs incurred subsequent to establish-

ment of technological feasibility to produce the finished

product are capitalized. The annual amortization of the

capitalized amounts is the greater of the amount

computed based on the estimated revenue distribution

over the products’ revenue-producing lives, or the

straight-line method, and is applied over periods ranging

up to four years. Periodic reviews are performed

to ensure that unamortized program costs remain

recoverable from future revenue. Costs to support or

service licensed programs are charged against income

as incurred, or when related revenue is recognized,

whichever occurs first.

Retirement Plans and Nonpension Postretirement Benefits

Current service costs of retirement plans and post-

retirement healthcare and life insurance benefits are

accrued in the period. Prior service costs resulting from

amendments to the plans are amortized over the average

remaining service period of employees expected to

receive benefits.

Goodwill

Goodwill is charged to earnings on a straight-line basis

over the periods estimated to be benefited, generally not

exceeding five years.

Common Stock

Common stock refers to the $.50 par value capital stock

as designated in the company’s Certificate of Incorporation.

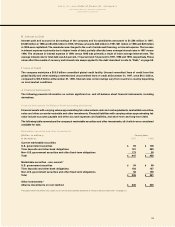

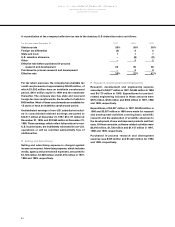

BAccounting Changes

The company implemented new accounting standards

in 1997, 1996 and 1995. None of these standards had a

material effect on the financial position or results of

operations of the company.

In December 1997, the company implemented SFAS 128,

“Earnings Per Share” (EPS). This standard prescribes the

methods for calculating basic and diluted EPS and

requires dual presentation of these amounts on the face

of the earnings statement. All EPS amounts are calculated

in accordance with SFAS 128; no restatement of EPS, for

either basic or diluted, was required for amounts reported

previously in the company’s filings with the U.S. Securities

and Exchange Commission.

Effective January 1, 1997, the company implemented

SFAS 125, “Accounting for Transfers and Servicing of

Financial Assets and Extinguishments of Liabilities.” This

standard provides accounting and reporting standards

for transfers and servicing of financial assets and

extinguishments of liabilities. The company was generally

in compliance with this standard prior to adoption.

In 1996, the company adopted the American Institute

of Certified Public Accountants Statement of Position

(SOP) 96-1, “Environmental Remediation Liabilities.”

This SOP provides guidance on the recognition,

measurement, display and disclosure of environmental

remediation liabilities. See note L, “Other Liabilities and

Environmental,” on page 61 for further information. The

company was generally in compliance with this standard

prior to adoption.

In 1996, the company implemented the disclosure-only

provisions of SFAS 123, “Accounting for Stock-Based

Compensation.” See note T, “Stock-Based Compensation

Plans,” on pages 68 through 70 for further information.

55