IBM 1997 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 1997 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

notes to consolidated financial statements

International Business Machines Corporation

and Subsidiary Companies

57

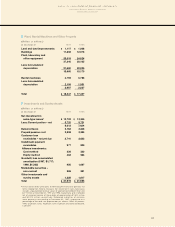

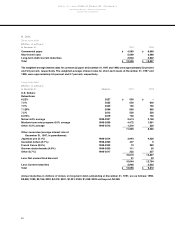

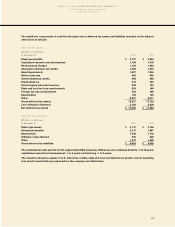

E Plant, Rental Machines and Other Property

(Dollars in millions)

At December 31:1997 1996

Land and land improvements $1,117 $1,208

Buildings 11,208 12,073

Plant, laboratory and

office equipment 25,015 24,824

_________________ _________________

37,340 38,105

Less: Accumulated

depreciation 21,680 22,935

_________________ _________________

15,660 15,170

Rental machines 4,793 3,788

Less: Accumulated

depreciation 2,106 1,551

_________________ _________________

2,687 2,237

_________________ _________________

Total $18,347 $17,407

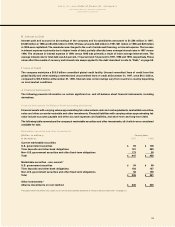

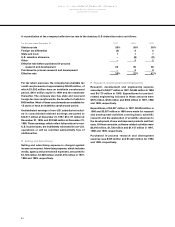

F Investments and Sundry Assets

(Dollars in millions)

At December 31:1997 1996

Net investment in

sales-type leases*$13,733 $13,345

Less: Current portion – net 5,720 5,721

_________________ _________________

8,013 7,624

Deferred taxes 3,163 3,246

Prepaid pension cost 3,828 3,324

Customer loan

receivables – not yet due 2,741 2,622

Installment payment

receivables 977 830

Alliance investments:

Cost method 236 320

Equity method 484 564

Goodwill, less accumulated

amortization (1997, $1,717;

1996, $1,300) 950 1,067

Marketable securities –

non-current 295 381

Other investments and

sundry assets 1,228 1,617

_________________ _________________

Total $21,915 $21,595

*These leases relate principally to IBM equipment and are generally for

terms ranging from three to five years. Net investment in sales-type leases

includes unguaranteed residual values of approximately $563 million and

$471 million at December 31, 1997 and 1996, respectively, and is reflected

net of unearned income at these dates of approximately $1,600 million

and $2,000 million, respectively. Scheduled maturities of minimum

lease payments outstanding at December 31, 1997, expressed as a

percentage of the total, are approximately as follows: 1998, 45 percent;

1999, 32 percent; 2000, 16 percent; 2001, 5 percent; and 2002 and beyond,

2 percent.