IBM 1997 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 1997 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

management discussion

International Business Machines Corporation

and Subsidiary Companies

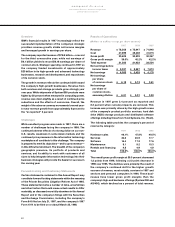

Financing Risks

Global financing is an integral part of the company’s total worldwide offerings. Financial results of global financing can

be found in note Q, “Global Financing,” on pages 65 and 66. Inherent in global financing are certain risks, including

credit, interest rate, currency and residual value. The company manages credit risk through comprehensive credit

evaluations and pricing practices. To manage the risks associated with an uncertain interest rate environment, the

company pursues a funding strategy of substantially matching the terms of its debt with the terms of its assets. Currency

risks are managed by denominating liabilities in the same currency as the assets.

Residual value risk is managed by developing projections of future equipment values at lease inception, reevaluating

these projections periodically, and effectively deploying remarketing capabilities to recover residual values and potentially

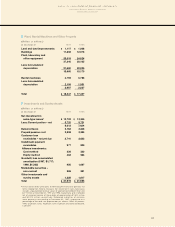

earn a profit. In 1997, 1996 and 1995, the remarketing effort generated profits. The following table depicts an approximation

of the unguaranteed residual value maturities for the company’s sales-type leases, as well as a projection of net book

value of operating leases at the end of the lease terms as of December 31, 1995, 1996 and 1997. The following table excludes

approximately $49 million of estimated residual value associated with non-information technology equipment.

Total Run Out of 1997 Residual Value Balance

(Dollars in millions) 2001 and

1995 1996 1997 1998 1999 2000 beyond

Sales-type leases $470 $471 $563 $120 $205 $205 $33

Operating leases 295 480 701 247 266 166 22

______________ _______________ _______________ ______________ _____________ _______________ ______________

Total residual value $765 $951 $1,264 $367 $471 $371 $55

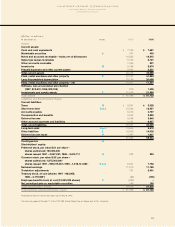

Acquisitions

On April 16, 1997, IBM and NetObjects, Inc. announced

that IBM had purchased a majority interest in NetObjects,

a leading provider of website development tools for

designers and intranet developers. In September 1997,

the company acquired the 30 percent equity interest held

by Sears in Advantis, the U.S. network services arm of

the IBM Global Network. Advantis is now 100 percent

owned by IBM. In December 1997, the company acquired

Eastman Kodak’s share of Technology Service Solutions

(TSS), which was formed in 1994 by IBM and Eastman

Kodak. TSS is now a wholly owned subsidiary of IBM,

offering comprehensive services solutions to its customers.

In addition, the company acquired Unison Software, Inc.,

a leading developer of workload management software,

and announced plans to acquire Software Artistry, Inc.,

a leading provider of both consolidated service desk and

customer relationship management solutions for distrib-

uted enterprise environments.

On March 1, 1996, the company acquired all outstanding

shares of Tivoli for approximately $800 million ($716 million

in net cash). On July 5, 1995, the company acquired all

outstanding shares of Lotus for approximately $3.2 billion

($2.9 billion in net cash). The company engaged a nationally

recognized, independent appraisal firm to express an

opinion on the fair market value of the assets of each of the

acquisitions to serve as a basis for allocation of the

purchase price to the various classes of assets. The

company allocated the total purchase prices as follows:

1996 1995

(Dollars in millions) Tivoli Lotus

Tangible and intangible

net assets $140 $1,157

Purchased in-process

research and development 417 1,840

Goodwill 280 540

Deferred tax liabilities related

to identifiable intangible

assets (37) (291)

__________________ __________________

Total $800 $3,246

Purchased in-process research and development

represents the value of software products still in the

development stage and not considered to have reached

technological feasibility.