IBM 1997 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 1997 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

notes to consolidated financial statements

International Business Machines Corporation

and Subsidiary Companies

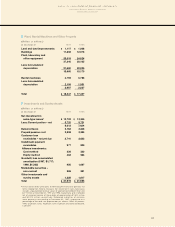

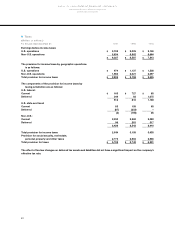

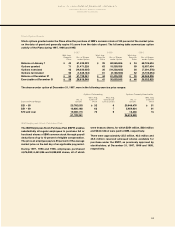

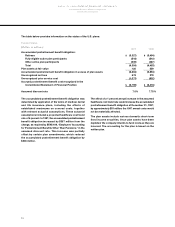

A reconciliation of the company’s effective tax rate to the statutory U.S. federal tax rate is as follows:

For the year ended December 31: 1997 1996 1995

Statutory rate 35% 35% 35%

Foreign tax differential (3) 2 2

State and local 111

U.S. valuation allowance – (6) (2)

Other –32

______________ ______________ ______________

Effective rate before purchased in-process

research and development 33 35 38

Purchased in-process research and development – 2 9

______________ ______________ ______________

Effective rate 33% 37% 47%

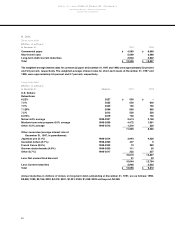

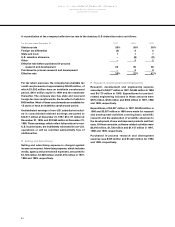

For tax return purposes, the company has available tax

credit carryforwards of approximately $2,035 million, of

which $1,092 million have an indefinite carryforward

period, $431 million expire in 1999 and the remainder

thereafter. The company also has state and local and

foreign tax loss carryforwards, the tax effect of which is

$405 million. Most of these carryforwards are available for

15 years or have an indefinite carryforward period.

Undistributed earnings of non-U.S. subsidiaries includ-

ed in consolidated retained earnings amounted to

$12,511 million at December 31, 1997, $12,111 million at

December 31, 1996, and $12,565 million at December 31,

1995. These earnings, which reflect full provision for non-

U.S. income taxes, are indefinitely reinvested in non-U.S.

operations or will be remitted substantially free of

additional tax.

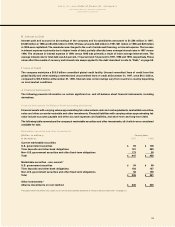

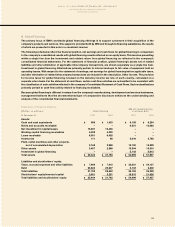

O Selling and Advertising

Selling and advertising expense is charged against

income as incurred. Advertising expense, which includes

media, agency and promotional expenses, amounted to

$1,708 million, $1,569 million and $1,315 million in 1997,

1996 and 1995, respectively.

P Research, Development and Engineering

Research, development and engineering expense

amounted to $4,877 million in 1997, $4,654 million in 1996

and $4,170 million in 1995. Expenditures for product-

related engineering included in these amounts were

$570 million, $720 million and $783 million in 1997, 1996

and 1995, respectively.

Expenditures of $4,307 million in 1997, $3,934 million in

1996 and $3,387 million in 1995 were made for research

and development activities covering basic scientific

research and the application of scientific advances to

the development of new and improved products and their

uses. Of these amounts, software-related activities were

$2,016 million, $1,726 million and $1,157 million in 1997,

1996 and 1995, respectively.

Purchased in-process research and development

expense was $435 million and $1,840 million for 1996

and 1995, respectively.