IBM 1997 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 1997 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

notes to consolidated financial statements

International Business Machines Corporation

and Subsidiary Companies

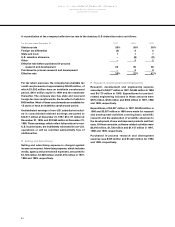

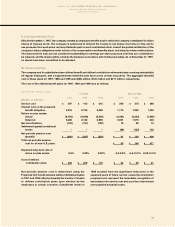

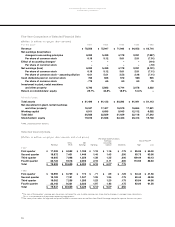

The table below provides information on the status of the U.S. plans:

Funded Status

(Dollars in millions) 1997 1996

Accumulated postretirement benefit obligation:

Retirees $(5,327) $(5,454)

Fully eligible active plan participants (518) (512)

Other active plan participants (539) (487)

________________ ________________

Total (6,384) (6,453)

Plan assets at fair value 120 559

________________ ________________

Accumulated postretirement benefit obligation in excess of plan assets (6,264) (5,894)

Unrecognized net loss 578 378

Unrecognized prior service cost (1,073) (902)

________________ ________________

Accrued postretirement benefit cost recognized in the

Consolidated Statement of Financial Position $(6,759) $(6,418)

Assumed discount rate 7.0% 7.75%

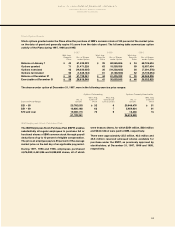

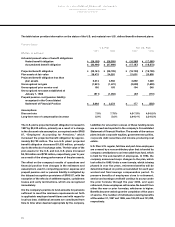

The accumulated postretirement benefit obligation was

determined by application of the terms of medical, dental

and life insurance plans, including the effects of

established maximums on covered costs, together

with relevant actuarial assumptions. These actuarial

assumptions included a projected healthcare cost trend

rate of 6 percent. In 1997, the accumulated postretirement

benefit obligation increased by $387 million from the

change, as required by SFAS 106, “Employers’ Accounting

for Postretirement Benefits Other Than Pensions,” in the

assumed discount rate. This increase was partially

offset by certain plan amendments, which reduced

the accumulated postretirement benefit obligation by

$300 million.

The effect of a 1 percent annual increase in the assumed

healthcare cost trend rate would increase the accumulated

postretirement benefit obligation at December 31, 1997,

by approximately $51 million; the 1997 annual costs would

not be materially affected.

The plan assets include various domestic short-term

fixed income securities. Once plan assets have been

depleted, the company intends to fund costs as they are

incurred. The accounting for the plan is based on the

written plan.