IBM 1997 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 1997 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

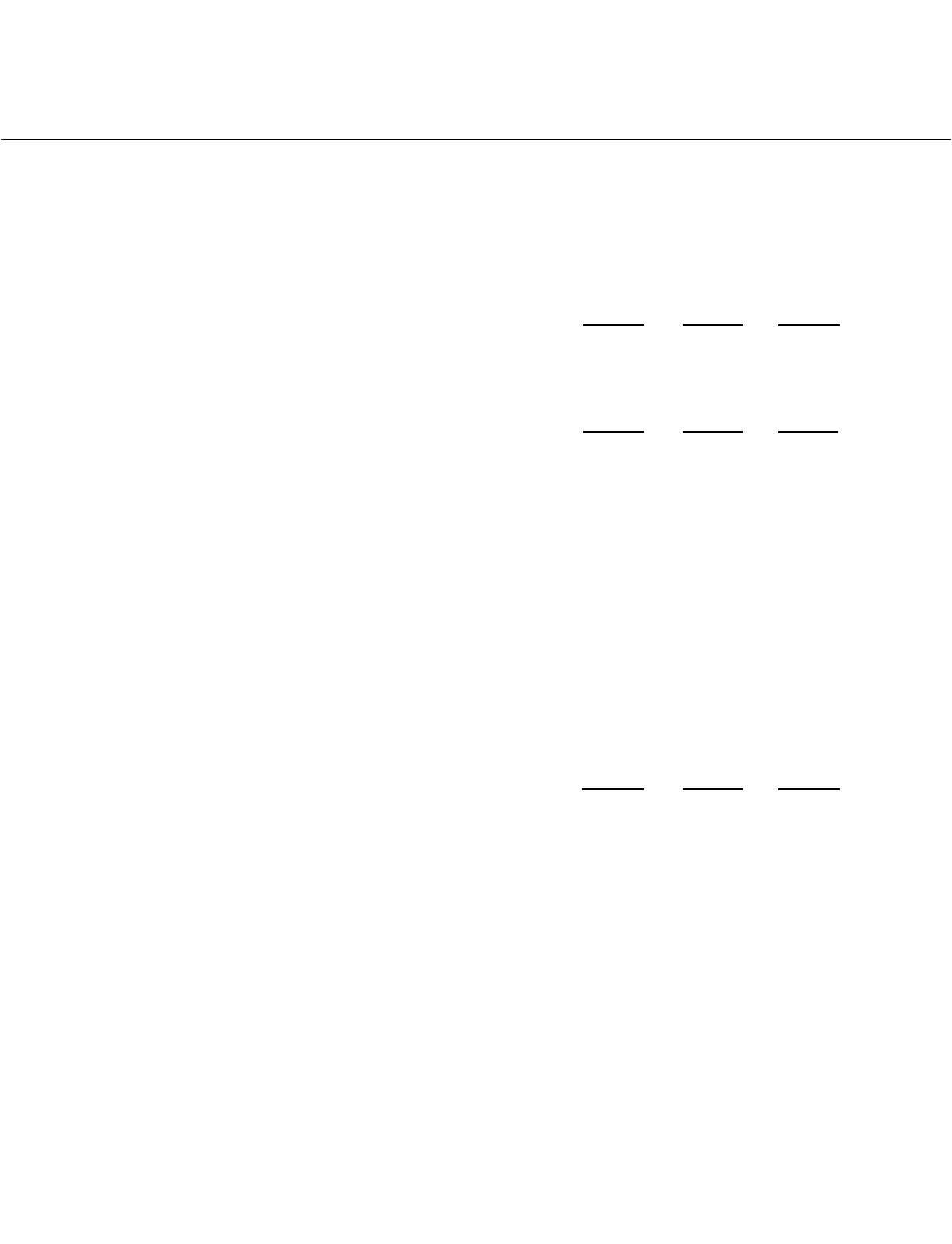

notes to consolidated financial statements

International Business Machines Corporation

and Subsidiary Companies

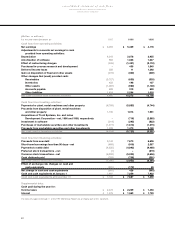

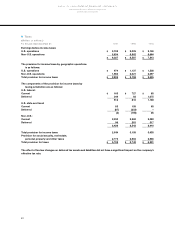

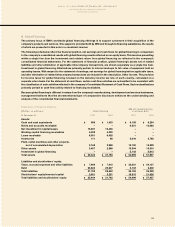

N Taxes

(Dollars in millions)

For the year ended December 31: 1997 1996 1995

Earnings before income taxes:

U.S. operations $3,193 $3,025 $2,149

Non-U.S. operations 5,834 5,562 5,664

__________________ _________________ __________________

$9,027 $8,587 $7,813

The provision for income taxes by geographic operations

is as follows:

U.S. operations $974 $1,137 $1,538

Non-U.S. operations 1,960 2,021 2,097

__________________ _________________ __________________

Total provision for income taxes $2,934 $3,158 $3,635

The components of the provision for income taxes by

taxing jurisdiction are as follows:

U.S. federal:

Current $163 $727 $85

Deferred 349 83 1,075

__________________ _________________ __________________

512 810 1,160

U.S. state and local:

Current 83 158 65

Deferred (87) (353) –

__________________ _________________ __________________

(4) (195) 65

Non-U.S.:

Current 2,330 2,262 2,093

Deferred 96 281 317

__________________ _________________ __________________

2,426 2,543 2,410

__________________ _________________ __________________

Total provision for income taxes 2,934 3,158 3,635

Provision for social security, real estate,

personal property and other taxes 2,774 2,584 2,566

__________________ _________________ __________________

Total provision for taxes $5,708 $5,742 $6,201

The effect of tax law changes on deferred tax assets and liabilities did not have a significant impact on the company’s

effective tax rate.