IBM 1997 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 1997 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

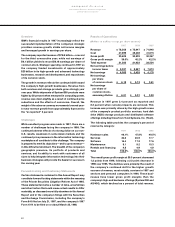

Services

(Dollars in millions)

1997 1996 1995

Revenue $19,302 $15,873 $12,714

Cost 15,281 12,647 10,042

__________________ _________________ _________________

Gross profit $4,021 $3,226 $2,672

Gross profit margin 20.8% 20.3% 21.0%

Services revenue increased 21.6 percent in 1997 (up

about 28 percent in constant currency) from 1996 and

24.8 percent in 1996 over 1995. The increases were driven

by continued strong growth in professional services,

which includes managed operation of systems, as well as

systems integration design and development. Network

services, which includes managed operation of networks,

and product support services continued to experience

good growth in revenue year over year. In 1997, the

company signed service contracts worth $24 billion. The

company continued to meet this growing demand for its

services business by hiring over 15,000 employees in

both 1997 and 1996, while maintaining a consistent gross

profit margin.

Software

(Dollars in millions)

1997 1996 1995

Revenue $12,844 $13,052 $12,657

Cost 3,784 4,082 4,428

__________________ _________________ _________________

Gross profit $9,060 $8,970 $8,229

Gross profit margin 70.5% 68.7% 65.0%

Software revenue decreased 1.6 percent in 1997 (up about

4 percent in constant currency) from 1996, following an

increase of 3.1 percent in 1996 over 1995. The revenue

decrease in 1997 was a result of lower host-based

computer software revenue primarily associated with

System/390 products. This decrease was offset by revenue

growth for systems management software from Tivoli.

While down for the year, software revenue performance

strengthened over the course of the year with fourth

quarter 1997 revenue increasing 1.4 percent versus the

fourth quarter of 1996. The increase in 1996 revenue was

driven by distributed software offerings from Lotus and

software products from Tivoli, partially offset by lower

host-based computer software revenue from System/390

and AS/400.

Software gross profit dollars increased 1.0 percent in

1997 from 1996, following an increase of 9.0 percent in

1996 from 1995. The improvement in gross profit dollars

was the result of more software development spending

being expensed in the period incurred and less being

capitalized in relation to prior historical levels, which in

turn yielded less amortization of previously deferred

costs. These lower amortization costs were partially

offset by higher vendor royalty costs.

Maintenance

(Dollars in millions)

1997 1996 1995

Revenue $6,402 $6,981 $7,409

Cost 3,394 3,659 3,651

__________________ __________________ __________________

Gross profit $3,008 $3,322 $3,758

Gross profit margin 47.0% 47.6% 50.7%

Maintenance revenue decreased 8.3 percent in 1997

(down about 3 percent in constant currency) from 1996,

following a decrease of 5.8 percent in 1996 versus 1995.

Gross profit dollars decreased 9.5 percent, following a

decrease of 11.6 percent in 1996 from 1995. Revenue and

gross profit dollars continue to be affected by price

reductions on maintenance offerings.

Rentals and Financing

(Dollars in millions)

1997 1996 1995

Revenue $3,731 $3,725 $3,560

Cost 1,902 1,624 1,590

__________________ __________________ __________________

Gross profit $1,829 $2,101 $1,970

Gross profit margin 49.0% 56.4% 55.4%

Rentals and financing revenue was essentially flat (up

about 4 percent in constant currency) in 1997 versus

1996, following an increase of 4.6 percent in 1996 from

1995. Although revenue was essentially flat versus 1996,

operating lease activity grew, but was offset by

lower dealer financing. Gross profit dollars decreased

12.9 percent from 1996, following an increase of

6.6 percent in 1996 from 1995. The decrease was primarily

a result of a trend towards financing a greater volume of

low-end products and faster growth in the more

competitive U.S. market. The increase in 1996 over 1995

was primarily a result of higher margins on operating

leases and lower interest rates. The financing results are

discussed in more detail in note Q, “Global Financing,” on

pages 65 and 66.

management discussion

International Business Machines Corporation

and Subsidiary Companies

42