IBM 1997 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 1997 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

notes to consolidated financial statements

International Business Machines Corporation

and Subsidiary Companies

63

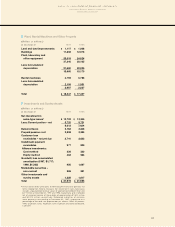

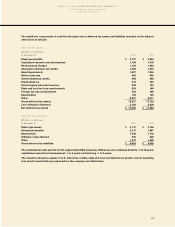

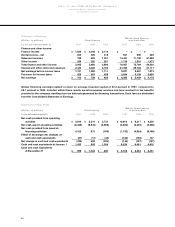

The significant components of activities that gave rise to deferred tax assets and liabilities included on the balance

sheet were as follows:

Deferred Tax Assets

(Dollars in millions)

At December 31: 1997 1996

Employee benefits $3,707 $3,554

Capitalized research and development 1,196 1,478

Restructuring charges 1,163 1,323

Alternative minimum tax credits 1,092 1,016

Asset impairments 1,027 1,304

Deferred income 893 993

General business credits 492 452

Equity alliances 378 340

Intracompany sales and services 235 194

State and local tax loss carryforwards 203 166

Foreign tax loss carryforwards 202 368

Depreciation 132 123

Other 2,507 2,411

_________________ _________________

Gross deferred tax assets 13,227 13,722

Less: Valuation allowance 2,163 2,239

_________________ _________________

Net deferred tax assets $11,064 $11,483

Deferred Tax Liabilities

(Dollars in millions)

At December 31: 1997 1996

Sales-type leases $3,147 $3,126

Retirement benefits 2,147 1,967

Depreciation 1,556 1,702

Software costs deferred 420 648

Other 1,413 1,465

_________________ _________________

Gross deferred tax liabilities $8,683 $8,908

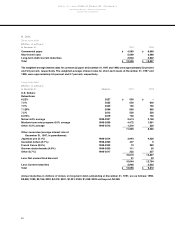

The estimated reversal periods for the largest deductible temporary differences are: employee benefits –1 to 30 years;

capitalized research and development –1 to 6 years; restructuring –1 to 5 years.

The valuation allowance applies to U.S. federal tax credits, state and local net deferred tax assets, and net operating

loss carryforwards that may expire before the company can utilize them.