IBM 1997 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 1997 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

management discussion

International Business Machines Corporation

and Subsidiary Companies

Net earnings per share of common stock were $6.18,

$5.12 and $3.61 in 1997, 1996 and 1995, respectively.

The following information, which is provided for infor-

mational purposes only, excludes the effects of a

$435 million non-tax deductible charge for purchased

in-process research and development in connection with

the Tivoli and Object Technology International, Inc.

acquisitions in March 1996. The 1995 results exclude the

effects of the third quarter charge of $1,840 million for

purchased in-process research and development in

connection with the Lotus Development Company

(Lotus) acquisition.

(Dollars in millions except per share amounts)

1997 1996 1995

Adjusted net

earnings $6,093 $5,864 $6,018

Adjusted net earnings

per share of

common stock $6.18 $5.53 $5.23

Adjusted net earnings

per share of

common stock–

assuming dilution $6.01 $5.41 $5.10

Hardware Sales

Information on revenue by classes of similar products

or services is included in note Y, “Segment Information,”

on page 75. The product trends addressed in this

discussion and in that disclosure are indicative, in all

material respects, of hardware sales activity.

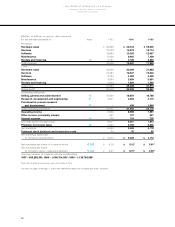

(Dollars in millions)

1997 1996 1995

Revenue $36,229 $36,316 $35,600

Cost 23,538 23,396 21,862

_________________ __________________ __________________

Gross profit $12,691 $12,920 $13,738

Gross profit margin 35.0% 35.6% 38.6%

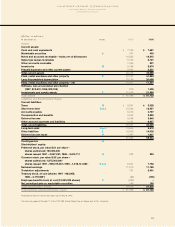

Revenue from hardware sales was essentially flat (up

about 4 percent in constant currency) from 1996, following

an increase of 2.0 percent in 1996 from 1995. Gross profit

dollars from hardware sales decreased 1.8 percent from

1996, following a decrease of 6.0 percent in 1996 from

1995.

Client revenue was flat versus 1996, following an increase

of 9.8 percent in 1996 over 1995. Although revenue was

flat in 1997, commercial personal computer revenue grew,

as did general-purpose monitors. These increases were

offset by lower revenue associated with consumer

personal computers and RS/6000 products. The 1996

increase over 1995 was driven by higher revenue from

personal computers, especially consumer products,

partially offset by lower revenue from RS/6000.

Revenue from servers decreased 4.5 percent from 1996,

following a decrease of 1.4 percent in 1996 versus 1995.

The 1997 decrease was primarily driven by lower revenue

from System/390, AS/400 and RS/6000 servers. While

System/390 revenue declined, total delivery of mainframe

computing power increased 30 percent as measured in

MIPS (millions of instructions per second) versus last

year. AS/400 and RS/6000 revenue was impacted by a

major product transition during the year, as new models

of these products were announced late in the third quarter

of 1997. These decreases were partially offset by higher

revenue from personal computer servers and large-scale

systems (SP) servers. The decrease in 1996 from 1995

was driven by lower revenue from System/390 servers,

partially offset by higher revenue from AS/400, RS/6000

and personal computer servers.

Storage products revenue decreased 1.9 percent versus

1996, following a decline of 15.9 percent in 1996 from

1995. The declines were driven by lower revenue from

high-end storage products, due to continuing price

competition, partially offset by revenue growth from tape

products.

Original Equipment Manufacturer (OEM) hardware

revenue increased 22.9 percent over 1996, following a

1.3 percent increase in 1996 versus 1995. The 1997

increase resulted from strong growth in HDD storage

products and custom logic products, partially offset by

continuing lower DRAM revenue, due to industry-wide

pricing pressures.

The decrease in the 1997 hardware sales gross profit

dollars was driven by the continued shift in the

company’s mix of revenue to lower gross profit products,

such as personal computers and OEM semiconductors,

partially offset by higher margins for System/390 servers

and storage products. The overall hardware sales margin

continues to be adversely impacted by pricing pressures

across all products.

41