IBM 1997 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 1997 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Effective January 1, 1995, the company implemented SFAS

114, “Accounting by Creditors for Impairment of a Loan,”

and SFAS 118, “Accounting by Creditors for Impairment

of a Loan—Income Recognition and Disclosures.” These

standards prescribe impairment measurements and

reporting related to certain loans.

The company implemented SFAS 116, “Accounting for

Contributions Received and Contributions Made,”

effective January 1, 1995. This standard requires that the

fair value of contributions, including unconditional

promises to give, be recognized as expense in the

period made.

In 1995, the company implemented SFAS 121, “Accounting

for the Impairment of Long-Lived Assets and for Long-

Lived Assets to Be Disposed Of.” This standard prescribes

the method for asset impairment evaluation for long-

lived assets and certain identifiable intangibles that are

either to be held and used or intended for disposal. The

company was generally in conformance with this standard

prior to adoption.

In 1995, the company adopted the American Institute of

Certified Public Accountants SOP 93-7, “Reporting on

Advertising Costs.” This SOP provides guidance on

financial reporting of advertising costs in annual financial

statements. See note O, “Selling and Advertising,” on

page 64 for additional disclosure on advertising expenses.

The company was generally in conformance with this

SOP prior to adoption.

In 1998, the company will implement two accounting

standards issued by the Financial Accounting Standards

Board in June of 1997. SFAS 130, “Reporting Comprehensive

Income,” and SFAS 131, “Disclosures About Segments of

an Enterprise and Related Information,” will have no effect

on the company’s financial position or results of operations

as they require only changes in or additions to current

disclosures.

During 1997, the Accounting Standards Executive

Committee of the American Institute of Certified Public

Accountants issued SOP 97-2, “Software Revenue

Recognition.” This SOP provides guidance on revenue

recognition on software transactions and is effective for

transactions entered into in fiscal years beginning after

December 15, 1997. The company is taking steps to meet

the requirements of the SOP and expects that it will not

have a material impact on the financial position or results

of operations of the company.

C Common Stock Split

On April 29, 1997, the stockholders of the company

approved amendments to the Certificate of Incorporation

to increase the number of authorized shares of common

stock from 750 million to 1,875 million, which was required

to effect a two-for-one stock split approved by the

company’s Board of Directors on January 28, 1997. In

addition, the amendments served to reduce the par value

of the common stock from $1.25 to $.50 per share.

Stockholders of record at the close of business on

May 9, 1997, received one additional share for each share

held. All share and per share data prior to the second

quarter of 1997 presented in the Consolidated Financial

Statements and footnotes of this annual report reflect

the two-for-one stock split.

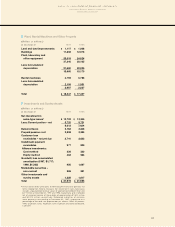

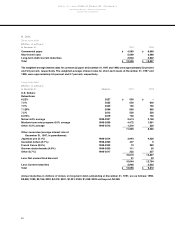

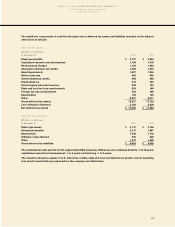

D Inventories

(Dollars in millions)

At December 31: 1997 1996

Finished goods $1,090 $1,413

Work in process 4,026 4,377

Raw materials 23 80

_________________ __________________

Total $5,139 $5,870

notes to consolidated financial statements

International Business Machines Corporation

and Subsidiary Companies

56