IBM 1997 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 1997 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

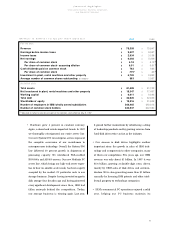

For the year:

Revenue $78,508 $75,947

Earnings before income taxes $9,027 $8,587

Income taxes $2,934 $3,158

Net earnings $6,093 $5,429

Per share of common stock $6.18 $5.12*

Per share of common stock - assuming dilution $6.01 $5.01*

Cash dividends paid on common stock $763 $686

Per share of common stock $.775* $.65*

Investment in plant, rental machines and other property $6,793 $5,883

Average number of common shares outstanding (in millions) 983 1,057

At end of year:

Total assets $81,499 $81,132

Net investment in plant, rental machines and other property $18,347 $17,407

Working capital $6,911 $6,695

Total debt $26,926 $22,829

Stockholders’ equity $19,816 $21,628

Number of employees in IBM/wholly owned subsidiaries 269,465 240,615

Number of common stock holders 623,537 622,594

*Adjusted to reflect a two-for-one split of the common stock effective May 9, 1997

•Hardware grew 4 percent in constant currency.

Again, a closer look reveals important trends. In 1997

we thoroughly reinvigorated our entire server line.

Our new System/ 390 G4 enterprise servers represent

the complete conversion of our mainframes to

microprocessor technology. Overall, the System/ 390

line delivered 30 percent growth in shipments of

processing capacity. We introduced Web-enabled

RS/ 6000s and AS/400 servers. Our new Netfinity PC

server line, which brings our high-end server exper-

tise to bear on smaller-scale needs, has been eagerly

accepted by the market. Of particular note is our

storage business. Despite having invented magnetic

disk storage four decades ago and having pioneered

every significant development since then, IBM had

fallen seriously behind the competition. Today,

our storage business is winning again. Last year,

it gained further momentum by introducing a string

of leadership products and by growing revenue from

hard-disk drives twice as fast as the industry.

•Our success in disk drives highlights another

important story: the growth in sales of IBM tech-

nology and components to other companies, many

of them our competitors. Five years ago, our OEM

revenue was only about $1 billion. In 1997 it was

$5.6 billion, growing at double-digit rates, driven

mainly by OEM sales of disk drives and semicon-

ductors. We’re also generating more than $1 billion

annually by licensing IBM patents and other intel-

lectual property to technology companies.

•IBM’s commercial PC operations enjoyed a solid

year, helping our PC business maintain its

5

(Dollars in millions except per share amounts) 1997 1996

financial highlights

International Business Machines Corporation

and Subsidiary Companies