IBM 1997 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 1997 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

notes to consolidated financial statements

International Business Machines Corporation

and Subsidiary Companies

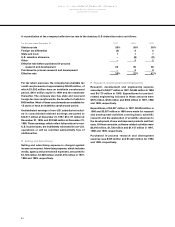

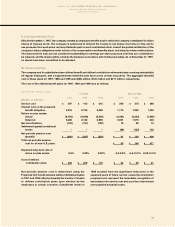

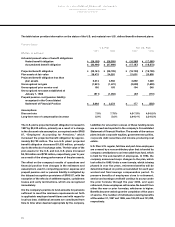

V Employee Benefits Trust

Effective November 1, 1997, the company created an employee benefits trust to which the company contributed 10 million

shares of treasury stock. The company is authorized to instruct the trustee to sell shares from time to time and to

use proceeds from such sales, and any dividends paid on such contributed stock, toward the partial satisfaction of the

company’s future obligations under certain of its compensation and benefits plans, including its retiree medical plans.

The shares held in trust are not considered outstanding for earnings per share purposes until they are committed to

be released, and the shares will be voted by the trustee in accordance with its fiduciary duties. As of December 31, 1997,

no shares have been committed to be released.

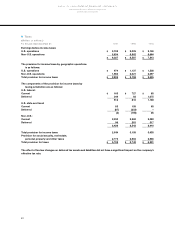

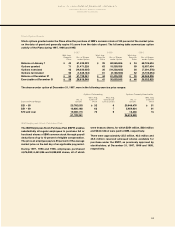

W Retirement Plans

The company and its subsidiaries have defined benefit and defined contribution retirement plans covering substantially

all regular employees, and a supplemental retirement plan that covers certain executives. The aggregate (benefit)

cost of these plans for 1997, 1996 and 1995 was $(50) million, $120 million and $377 million, respectively.

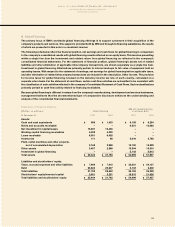

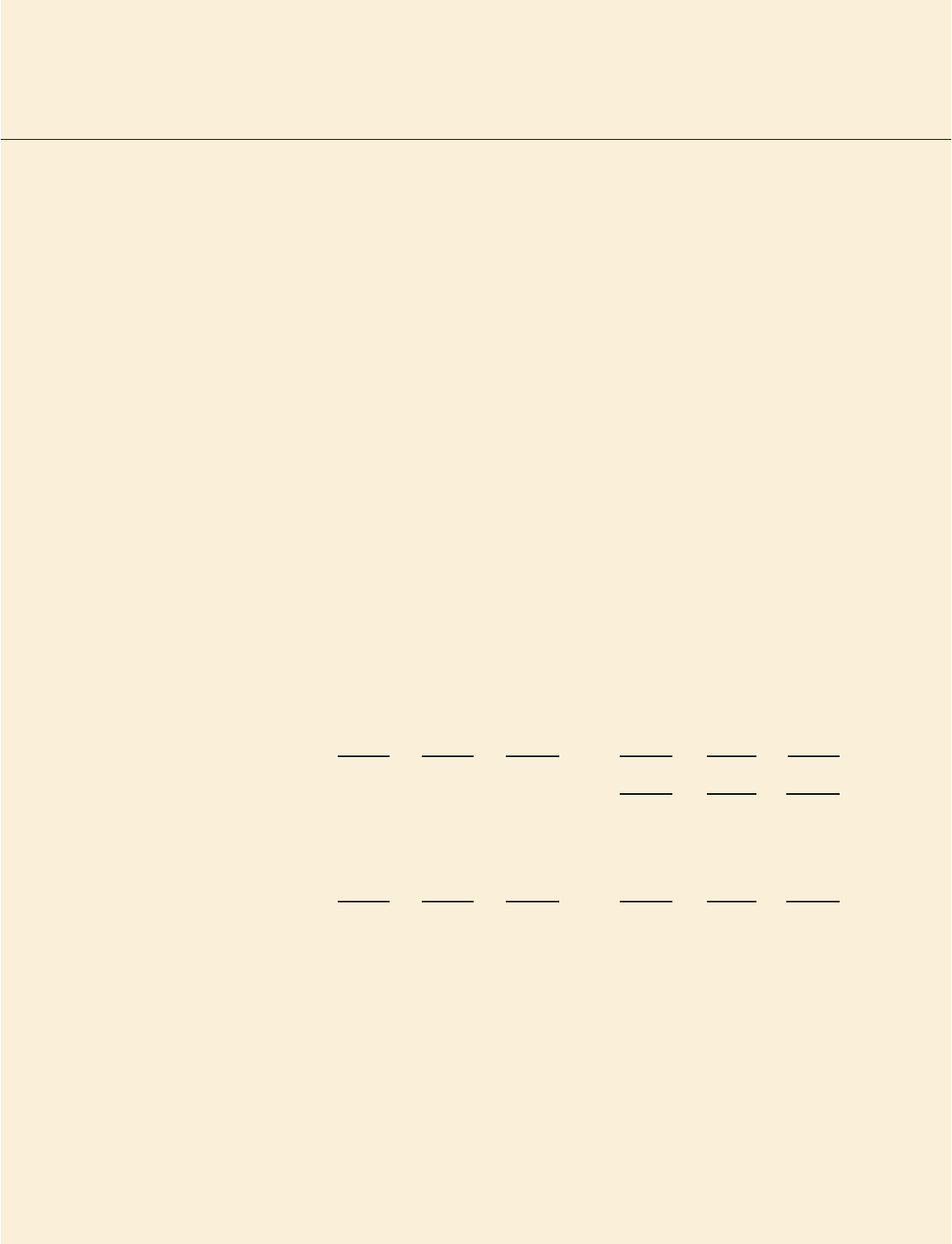

The cost of the defined benefit plans for 1997, 1996 and 1995 was as follows:

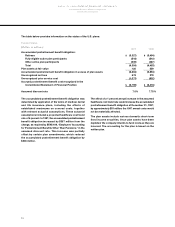

Net Periodic Pension Cost

U.S. Plan Non-U.S. Plans

1997 1996 1995 1997 1996 1995

(Dollars in millions)

Service cost $397 $412 $315 $360 $378 $386

Interest cost on the projected

benefit obligation 2,215 2,125 2,098 1,173 1,292 1,325

Return on plan assets:

Actual (6,193) (4,849) (5,500) (3,461) (2,543) (1,848)

Deferred 3,286 2,148 2,958 2,021 1,075 403

Net amortizations (125) (121) (123) 16 28 12

Settlement (gains)/curtailment

losses – – – (68) (102) 128

_______________ _______________ _______________ _______________ ______________ _______________

Net periodic pension cost

(benefit) $(420) $(285) $(252) $41 $128 $406

Total net periodic pension

cost for all non-U.S. plans $50 $148 $417

Expected long-term rate of

return on plan assets 9.5% 9.25% 9.25% 6.0-9.5% 6.5-10.0% 6.25-10.0%

Cost of defined

contribution plans $236 $209 $176 $64 $29 $21

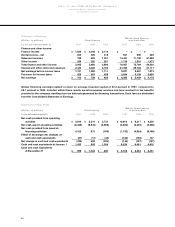

Net periodic pension cost is determined using the

Projected Unit Credit actuarial method. Settlement gains

in 1997 and 1996 reflect principally the transfer of assets

to defined contribution plans upon election by the

employees in certain countries. Curtailment losses in

1995 resulted from the significant reductions in the

expected years of future service caused by termination

programs and represent the immediate recognition of

associated prior service cost and a portion of previously

unrecognized actuarial losses.