IBM 1997 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 1997 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

notes to consolidated financial statements

International Business Machines Corporation

and Subsidiary Companies

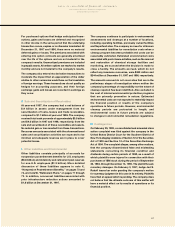

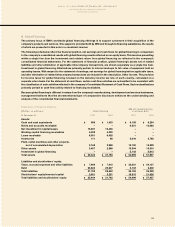

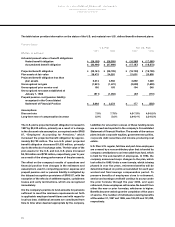

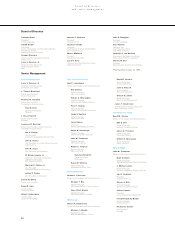

Pro Forma Disclosure

In applying APB Opinion 25, no expense was recognized for stock options granted under the Plan and for employee stock

purchases under the ESPP. SFAS 123 requires that a fair market value of all awards of stock-based compensation be

determined using standard techniques and that pro forma net earnings and earnings per share be disclosed as if the

resulting stock-based compensation amounts were recorded in the Consolidated Statement of Earnings as follows:

(Dollars in millions except per share amounts)

1997 1996 1995

As reported Pro forma As reported Pro forma As reported Pro forma

Net earnings applicable to

common shareholders $6,073 $5,866 $5,409 $5,267 $4,116 $4,020

Net earnings per share

of common stock $6.18 $5.97 $5.12 $4.98 $3.61 $3.53

Net earnings per share of

common stock - assuming dilution $6.01 $5.82 $5.01 $4.89 $3.53 $3.45

The above pro forma amounts, for purposes of SFAS 123,

reflect the portion of the estimated fair value of awards

earned in 1997, 1996 and 1995. The aggregate fair value

of awards granted is earned ratably over the vesting or

service period and is greater than that included in the

pro forma amounts.

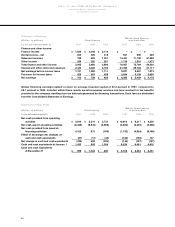

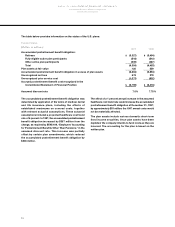

The company used the Black-Scholes model to value

the stock options granted in 1997, 1996 and 1995. The

weighted average assumptions used to estimate the

value of the options included in the pro forma amounts,

and the weighted average estimated fair value of an

option granted are as follows:

1997 1996 1995

Term (years)*5/6 5/6 5/6

Volatility** 23.0% 22.0% 21.0%

Risk-free interest rate

(zero coupon

U.S. Treasury note) 6.2% 6.0% 7.0%

Dividend yield 1.0% 1.2% 2.0%

Weighted average

fair value $25 $20 $12

**Option term is based on tax incentive options (5 years) and non-tax

incentive options (6 years).

** To determine volatility, the company measured the daily price changes of

the stock over the most recent 5 and 6 year periods.

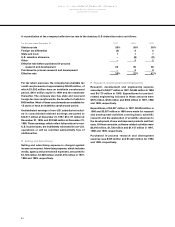

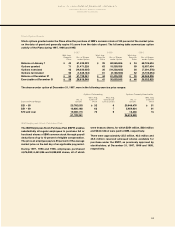

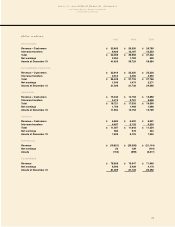

U Stock Repurchases

The Board of Directors has authorized the company

to repurchase IBM common stock. The company

repurchased 81,505,200 common shares at a cost of

$7,128 million and 98,930,400 common shares at a cost

of $5,810 million in 1997 and 1996, respectively. The

repurchases resulted in a reduction of $34,338,668 and

$61,831,500 in the stated capital (par value) associated

with common stock in 1997 and 1996, respectively. In

1997, 10 million repurchased shares were used to establish

the Employee Benefits Trust, while 2,727,864 and 979,000

in 1997 and 1996, respectively, were used to fund new

acquisitions. The rest of the repurchased shares were

retired and restored to the status of authorized but

unissued shares. At December 31, 1997, approximately

$2.7 billion of Board authorized repurchases remained. The

company plans to purchase shares on the open market

from time to time, depending on market conditions.

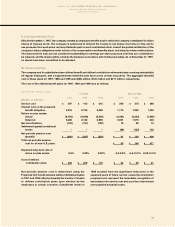

During 1995, the IBM Board of Directors authorized

the company to purchase all its outstanding Series A

71⁄2percent preferred stock. The company repurchased

13,450 shares at a cost of $1.4 million during 1997, which

resulted in a $134.50 ($.01 par value per share) reduction

in the stated capital associated with preferred stock. The

repurchased shares were retired and restored to the

status of authorized but unissued shares. No shares were

repurchased in 1996. The company plans to purchase

remaining shares on the open market and in private

transactions from time to time, depending on market

conditions.