IBM 1997 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 1997 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

management discussion

International Business Machines Corporation

and Subsidiary Companies

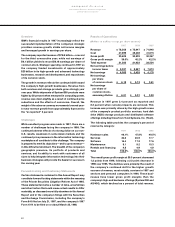

Cash Flows

The company’s cash flows from operating, investing and

financing activities as prescribed by generally accepted

accounting principles and reflected in the Consolidated

Statement of Cash Flows on page 52, are summarized

in the following table:

(Dollars in millions)

1997 1996 1995

Net cash provided

from (used in):

Operating activities $ 8,865 $ 10,275 $ 10,708

Investing activities (6,155) (5,723) (5,052)

Financing activities (3,090) (3,952) (6,384)

Effect of exchange

rate changes on cash

and cash equivalents (201) (172) 65

_________________ _________________ _________________

Net change in cash

and cash equivalents $(581) $428 $(663)

Working Capital

(Dollars in millions)

At December 31: 1997 1996

Current assets $40,418 $40,695

Current liabilities 33,507 34,000

_________________ _________________

Working capital $6,911 $6,695

Current ratio 1.21:1 1.20:1

Current assets decreased slightly due primarily to

aggressive inventory management. The company’s overall

net inventories declined $.7 billion driven substantially by

inventory management process improvements, partic-

ularly in personal computers. At December 31, 1997, the

company’s inventories stood at $5.1 billion, their lowest

level since year-end 1983.

Current liabilities were lower primarily due to a decrease

in taxes payable and liabilities for prior restructuring

actions.

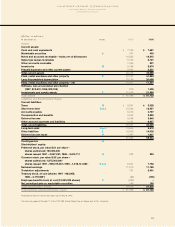

Investments

The company’s investments for plant, rental machines

and other property were $6.8 billion for 1997, an increase

of $.9 billion from 1996. The increase reflects continued

investment in the company’s rapidly growing services

business, principally in the management of customers’

information technology, and manufacturing capacity for

hard disk drives and microelectronics.

In addition to software development expenses included

in research, development and engineering, the company

capitalized $.3 billion of software costs during 1997 and

1996. Amortization of capitalized software costs amounted

to $1.0 billion for 1997, a decrease of $.4 billion from 1996.

Investments and sundry assets were $21.9 billion at the

end of 1997, an increase of $.3 billion from 1996, and

were primarily the result of increases in prepaid pension

assets and noncurrent sales type leases, offset by

decreases in other investments and sundry assets. See

note F, “Investments and Sundry Assets,” on page 57 for

additional information.

Debt and Equity

(Dollars in millions)

1997 1996

“Core” debt $3,102 $2,202

Global financing debt 23,824 20,627

__________________ ___________________

Total debt $26,926 $22,829

Stockholders’ equity $19,816 $21,628

Debt/capitalization 57.6% 51.4%

“Core” debt/capitalization 16.1% 10.7%

Global financing debt/equity 6.5:1 6.3:1

Total debt increased $4.1 billion from year-end 1996,

driven by an increase of $3.2 billion in debt to support

the growth in global financing assets and $.9 billion in

“core” debt. The company’s balance sheet is leveraged

with a “core” debt to capitalization of 16.1 percent and

global financing debt to equity at 6.5 to 1.

Stockholders’ equity declined $1.8 billion to $19.8 billion

at December 31, 1997. The company’s ongoing stock

repurchasing program (see note U, “Stock Repurchases,”

on page 70) and the creation of an Employee Benefits

Trust (see note V, “Employee Benefits Trust,” on page 71)

offset the $6.1 billion of net earnings for the year. The

translation effect of the stronger dollar on the company’s

non-U.S. net assets contributed $1.6 billion to the year-

to-year decline.

45