IBM 1997 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 1997 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

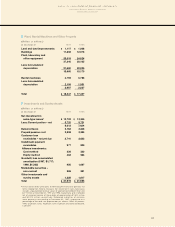

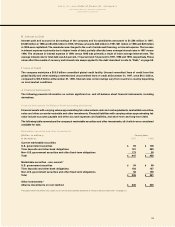

Financial Instruments Off-Balance Sheet (excluding derivatives)

IBM has guaranteed certain loans and financial commitments of affiliates. The fair market values of these financial

guarantees were $861 million and $787 million at December 31, 1997 and 1996, respectively. Additionally, the company

is contingently liable for commitments of various ventures to which it is a party and certain other contracts. These

commitments, which in the aggregate were approximately $600 million and $400 million at December 31, 1997 and 1996,

respectively, are not expected to have a material adverse effect on the company’s financial position or results of

operations.

The company’s dealers had unused lines of credit available from IBM for working capital financing of approximately

$2.1 billion at December 31, 1997 and 1996.

Derivative Financial Instruments

The company has used derivative instruments as an element of its risk management strategy for many years. Although

derivatives entail a risk of nonperformance by counterparties, the company manages this risk by establishing explicit

dollar and term limitations that correspond to the credit rating of each carefully selected counterparty. The company

has not sustained a material loss from these instruments nor does it anticipate any material adverse effect on its

results of operations or financial position in the future.

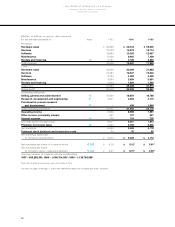

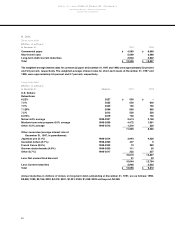

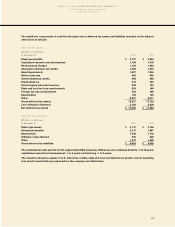

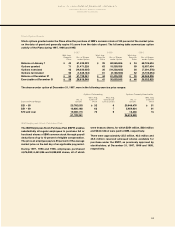

The following table summarizes the notional value, carrying value and fair value of the company’s derivative financial

instruments on- and off-balance sheet. The notional value at December 31 provides an indication of the extent of the

company’s involvement in such instruments at that time, but does not represent exposure to market risk.

At December 31, 1997 At December 31, 1996

Notional Carrying Fair Notional Carrying Fair

(Dollars in millions) Value Value Value*Value Value Value*

Interest rate and currency contracts $24,774 $29 $84 $18,700 $(70) $(117)

Option contracts 14,211 41 193 10,100 92 81

_________________ __________ ____________ _________________ __________ ____________

Total $38,985 $70 $277 $28,800 $22 $(36)

Bracketed amounts are liabilities.

*The estimated fair value of derivatives both on- and off-balance sheet at December 31, 1997 and 1996, consists of assets of $561 million and $258 million

and liabilities of $304 million and $294 million, respectively.

notes to consolidated financial statements

International Business Machines Corporation

and Subsidiary Companies

The majority of the company’s derivative transactions

relates to the matching of liabilities to assets associated

with its global financing business. The company issues

debt, using the most efficient capital markets and

products, which may result in a currency or interest rate

mismatch with the underlying lease. Interest rate swaps

or currency swaps are then used to match the interest

rates and currencies of its debt to the related global

financing receivables. These swap contracts are

principally one to five years in duration. Interest and

currency rate differentials accruing under interest rate and

currency swap contracts related to the global financing

business are recognized over the life of the contracts

in interest expense.

The company uses internal regional centers to manage

the cash of its subsidiaries. These regional centers

principally use currency swaps to convert cash flows in

a cost-effective manner, predominantly for the company’s

European subsidiaries. The terms of the swaps are

generally less than one year. The effects of these

contracts are recognized over the life of the contract in

interest income.

When the terms of the underlying instrument are modified,

or if it ceases to exist, all changes in fair value of the

swap contract are recognized in income each period until

it matures.

Additionally, the company uses derivatives to limit

its exposure to loss resulting from fluctuations in

foreign currency exchange rates on anticipated cash

transactions between foreign subsidiaries and the parent

company. The company receives significant dividends,

intracompany royalties and net payments for goods and

services from its non-U.S. subsidiaries. In anticipation

of these foreign currency flows, and given the volatility

of the currency markets, the company selectively employs

foreign currency options to manage the currency risk.

The terms of these instruments are generally less than

one year.