IBM 1997 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 1997 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

notes to consolidated financial statements

International Business Machines Corporation

and Subsidiary Companies

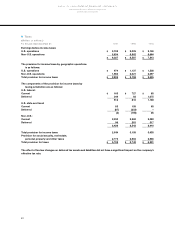

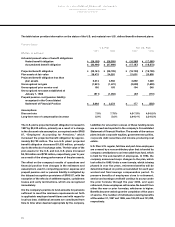

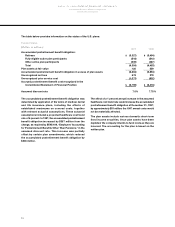

The table below provides information on the status of the U.S. and material non-U.S. defined benefit retirement plans:

Funded Status

U.S. Plan Non-U.S. Plans

1997 1996 1997 1996

(Dollars in millions)

Actuarial present value of benefit obligations:

Vested benefit obligation $(29,155) $(26,355) $(16,388) $(17,380)

Accumulated benefit obligation $(30,466) $(27,698) $(17,187) $(18,273)

Projected benefit obligation $(33,161) $(29,729) $(18,709) $(19,739)

Plan assets at fair value 38,475 34,281 21,601 20,808

__________________ __________________ __________________ __________________

Projected benefit obligation less than

plan assets 5,314 4,552 2,892 1,069

Unrecognized net gain (1,901) (1,421) (2,822) (1,539)

Unrecognized prior service cost 190 193 194 248

Unrecognized net asset established at

January 1, 1986 (911) (1,052) (87) (110)

__________________ __________________ __________________ __________________

Prepaid pension cost (pension liability)

recognized in the Consolidated

Statement of Financial Position $2,692 $2,272 $177 $(332)

Assumptions:

Discount rate 7.0% 7.75% 4.5-7.5% 4.5-8.5%

Long-term rate of compensation increase 5.0% 5.0% 2.6-6.1% 2.3-6.5%

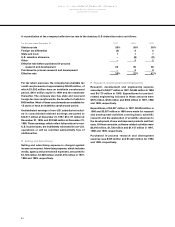

The U.S. plan’s projected benefit obligation increased in

1997 by $3,432 million, primarily as a result of a change

in the discount rate assumption, as required under SFAS

87, “Employers’ Accounting for Pensions,” which

increased the projected benefit obligation by approx-

imately $2,723 million. The non-U.S. plans’ projected

benefit obligation decreased $1,030 million, primarily

due to the effects of exchange rates. The fair value of the

plan assets for the U.S. and non-U.S. plans increased

$4,194 million and $793 million, respectively, year to year

as a result of the strong performance of the plan assets.

The effect on the company’s results of operations and

financial position from changes in the estimates and

assumptions used in computing pension expense and

prepaid pension cost or pension liability is mitigated by

the delayed recognition provisions of SFAS 87, with the

exception of the effects of settlement gains, curtailment

losses and early terminations, which are recognized

immediately.

It is the company’s practice to fund amounts for pensions

sufficient to meet the minimum requirements set forth

in applicable employee benefit laws and with regard to

local tax laws. Additional amounts are contributed from

time to time when deemed appropriate by the company.

Liabilities for amounts in excess of these funding levels

are accrued and reported in the company’s Consolidated

Statement of Financial Position. The assets of the various

plans include corporate equities, government securities,

corporate debt securities and income-producing real

estate.

U.S. Plan: U.S. regular, full-time and part-time employees

are covered by a noncontributory plan that is funded by

company contributions to an irrevocable trust fund, which

is held for the sole benefit of employees. In 1994, the

company announced major changes to the plan, which

took effect in 1995. Under a new formula, which is being

phased in over five years, retirement benefits will be

determined based on points accumulated for each year

worked and final average compensation period. To

preserve benefits of employees close to retirement,

service and earnings credit will continue to accrue under

the prior formula through the year 2000, and upon

retirement, these employees will receive the benefit from

either the new or prior formulas, whichever is higher.

Benefits become vested upon the completion of five years

of service. The number of individuals receiving benefits

at December 31, 1997 and 1996, was 108,415 and 101,293,

respectively.