IBM 1997 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 1997 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

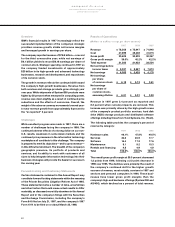

Currency had an approximately 6 percentage point

negative impact on the company’s revenue results in the

fourth quarter. At constant currency in the fourth quarter

of 1997, Asia Pacific revenue would have increased about

10 percent, European revenue would have grown

approximately 5 percent and revenue from Canada would

have increased about 19 percent.

Total hardware sales declined 1.3 percent year over year

to $11.5 billion. RS/6000, storage and semiconductor

revenue increased, while overall personal computer,

AS/400 and System/390 revenue declined. On a constant

currency basis, hardware sales increased in all key

hardware lines, except for System/390 and consumer

personal computers.

Services revenue totaled $5.9 billion, a 17.5 percent

increase compared to the year-earlier period. Approx-

imately $8.5 billion in new services contracts was signed

in the quarter. Services margins were essentially flat year

over year at 22.5 percent.

Overall software revenue was $3.8 billion, an increase of

1.4 percent compared with the fourth quarter of 1996.

Maintenance revenue declined 9.2 percent to $1.6 billion

in the fourth quarter when compared with the year-

earlier period, and rentals and financing fell 3.5 percent

to $1.0 billion.

The company’s overall gross profit margin in the fourth

quarter was 40.1 percent, compared to 40.3 percent in

the year-earlier period.

Total fourth-quarter 1997 expenses increased 1.1 percent

year over year. The expense-to-revenue ratio in the fourth

quarter of 1997 was 27.4 percent compared to 27.8 percent

in the year-earlier period.

The company’s tax rate was 30.5 percent in the fourth

quarter, compared to 29.9 percent in the fourth quarter

of 1996.

The company spent approximately $2 billion on share

repurchases in the fourth quarter. The average number of

shares outstanding in the fourth quarter of 1997 was

964.8 million, compared to 1,026.8 million in the year-

earlier period.

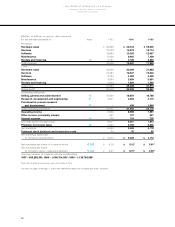

Financial Condition

During 1997, the company continued to make significant

investments to fund future growth and increase

shareholder value, expending $6.8 billion for plant, rental

machines and other property, $5.5 billion for research,

development and engineering, and $7.1 billion for the

repurchase of the company’s common shares. The

company had $7.6 billion in cash, cash equivalents and

marketable securities on hand at December 31, 1997.

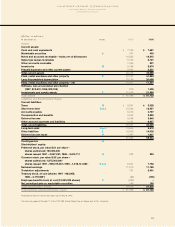

The company has access to global funding sources.

During 1997, the company issued debt in a variety of

geographies to a diverse set of investors. Significant

funding was issued in the United States, Japan and

Europe. Funding was obtained across the range of debt

maturities, from short-term commercial paper to long-

term debt. More information about company debt is

provided in note G, “Debt,” on page 58.

In December 1993, the company entered into a $10 billion

committed global credit facility to enhance the liquidity

of funds. This facility was amended in February 1997,

and extended to February 2002. As of December 31, 1997,

$9.2 billion was unused and available.

At year-end 1997, the company had an outstanding

balance of $.9 billion of assets under management from

the securitization of loans, leases and trade receivables,

compared to the year-end 1996 level of $1.1 billion. The

company has access to additional funds through securi-

tization, as discussed in note K, “Sale and Securitization

of Receivables,” on page 61.

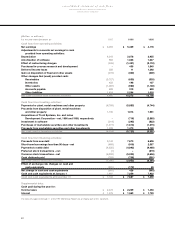

The rating agencies continued their review of the company’s

financial condition. In January 1997, Standard and Poor’s

revised its outlook on the company and its rated sub-

sidiaries to positive from stable and affirmed its ratings of

senior debt as A, commercial paper as A-1, and preferred

stock as A-.

Moody’s Investors Service rates the senior long-term

debt of the company and its rated subsidiaries as A1,

the commercial paper as Prime-1, and the company’s

preferred stock as “a1.”

Fitch Investors Service rates the company and its rated

subsidiaries’ senior long-term debt as AA-, commercial

paper as F-1+, and preferred stock as A+.

Duff & Phelps rates the company and its rated

subsidiaries’ senior long-term debt as A+, commercial

paper as Duff 1, and the company’s preferred stock as A.

management discussion

International Business Machines Corporation

and Subsidiary Companies

44