IBM 1997 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 1997 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

management discussion

International Business Machines Corporation

and Subsidiary Companies

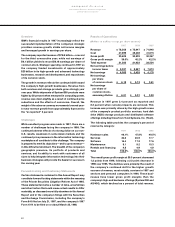

Currency Rate Fluctuations

Since approximately 81 percent of the company’s non-

U.S. revenue was derived from affiliates operating in

local currency environments, the company’s results are

affected by changes in the relative values of non-U.S.

currencies to the U.S. dollar. Most worldwide currencies

weakened versus the U.S. dollar in 1997, which resulted

in assets and liabilities denominated in local currencies

being translated into fewer dollars. The currency rate

changes also resulted in an unfavorable impact on

revenue of approximately 5 percent and 3 percent,

respectively, in 1997 and 1996, compared to a favorable

impact in 1995 of 4 percent.

In high-inflation environments, primarily parts of Latin

America, translation adjustments are reflected in period

income, as required by SFAS 52, “Foreign Currency

Translation.” Generally, the company limits currency risk

in these countries by linking prices and contracts to U.S.

dollars, by financing operations locally and through foreign

currency hedge contracts.

The company uses a variety of financial hedging

instruments to limit specific currency risks related to

global financing transactions and the repatriation of

dividends and royalties. Further discussion on currency

and hedging appears in note J, “Financial Instruments,”

on pages 59 through 61.

Market Risk

In the normal course of business, the financial position

of the company is routinely subjected to a variety of

risks. In addition to the market risk associated with

interest and currency rate movements on outstanding

debt and non-U.S. dollar denominated assets and

liabilities, other examples of risk include collectibility of

accounts receivable and recoverability of residual values

on leased assets.

The company regularly assesses these risks and has

established policies and business practices to protect

against the adverse effects of these and other potential

exposures. As a result, the company does not anticipate

any material losses in these areas.

The company’s debt in support of the global financing

business (see note Q, “Global Financing,” on pages 65

and 66) and the geographic breadth of the company’s

operations contain an element of market risk from changes

in interest and currency rates. The company manages

this risk, in part, through the use of a variety of financial

instruments including derivatives, as explained in note J,

“Financial Instruments,” on pages 59 through 61.

For purposes of specific risk analysis, the company uses

sensitivity analysis to determine the impacts that market

risk exposures may have on the fair values of the

company’s debt and financial instruments.

The financial instruments included in the sensitivity

analysis consist of all of the company’s cash and cash

equivalents, marketable securities, long-term non-lease

receivables, investments, long-term and short-term debt

and all derivative financial instruments. Interest rate

swaps, interest rate options, foreign currency swaps,

forward contracts and foreign currency option contracts

constitute the company’s portfolio of derivative financial

instruments.

To perform sensitivity analysis, the company assesses

the risk of loss in fair values from the impact of

hypothetical changes in interest rates and foreign currency

exchange rates on market sensitive instruments. The

market values for interest and foreign currency exchange

risk are computed based on the present value of future

cash flows as impacted by the changes in the rates

attributable to the market risk being measured. The

discount rates used for the present value computations

were selected based on market interest and foreign

currency exchange rates in effect at December 31, 1997.

The market values that result from these computations

are compared with the market values of these financial

instruments at December 31, 1997. The differences in

this comparison are the hypothetical gains or losses

associated with each type of risk.

The results of the sensitivity analysis at December 31, 1997,

are as follows:

Interest Rate Risk:

A 10 percent decrease in the levels of interest rates with

all other variables held constant would result in a decrease

in the fair value of the company’s financial instruments by

$369 million. A 10 percent increase in the levels of interest

rates with all other variables held constant would result

in an increase in the fair value of the company’s financial

instruments by $341 million.

Foreign Currency Exchange Rate Risk:

A 10 percent movement in the levels of foreign currency

exchange rates against the U.S. dollar with all other

variables held constant would result in a decrease in the

fair value of the company’s financial instruments by

$809 million or an increase in the fair value of the

company’s financial instruments by $981 million.