IBM 1997 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 1997 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overview

IBM’s financial results in 1997 increasingly reflect the

successful implementation of the company’s strategic

priorities: revenue growth, stable net income margins

and leveraged growth in earnings per share.

The company reported revenue of $78.5 billion— a record

for the third consecutive year; while net earnings of

$6.1 billion yielded a record $6.18 earnings per share of

common stock. Strategic spending continued in 1997 as

the company funded investments of approximately

$20 billion in its high-growth and advanced technology

businesses, research and development, and repurchases

of its common stock.

The growth in revenue reflects the continued shift toward

the company’s high-growth businesses. Revenue from

both services and storage products grew strongly year

over year. While shipments of System/390 products were

higher by 30 percent when measured in computing power,

revenue was down slightly as a result of continued price

reductions and the effects of currencies. Overall, the

weight of the adverse currency movements lowered year-

to-year revenue growth from approximately 8 percent to

the “as reported” 3 percent.

Challenges

While excellent progress was made in 1997, there are a

number of challenges facing the company in 1998. The

continued adverse effects of a strong dollar on our non-

U.S. results, weakness in some Asian markets and the

continued price pressures in the information technology

marketplace all contribute to this challenge. The company

is prepared to meet its objectives— and to grow revenue—

in this difficult environment. The breadth of the company’s

geographic presence, its portfolio of products and

services, and its ability to work with customers of all

sizes to help integrate information technology into their

business strategies will provide the basis for success in

the coming year.

Forward-looking and Cautionary Statements

Certain statements contained in this Annual Report may

constitute forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995.

These statements involve a number of risks, uncertainties

and other factors that could cause actual results to differ

materially, as discussed more fully elsewhere in this Annual

Report and in the company’s filings with the Securities

and Exchange Commission, including the company’s

Form 8-K filed on July 21, 1997, and the company’s 1997

Form 10-K to be filed on or about March 23, 1998.

Results of Operations

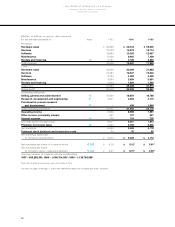

(Dollars in millions except per share amounts)

1997 1996 1995

Revenue $78,508 $75,947 $71,940

Cost 47,899 45,408 41,573

_________________ __________________ __________________

Gross profit 30,609 30,539 30,367

Gross profit margin 39.0% 40.2% 42.2%

Total expense 21,582 21,952 22,554

_________________ __________________ __________________

Net earnings before

income taxes $9,027 $8,587 $7,813

Net earnings $6,093 $5,429 $4,178

Net earnings

per share

of common stock $6.18 $5.12 $3.61

Net earnings

per share of

common stock–

assuming dilution $6.01 $5.01 $3.53

Revenue in 1997 grew 3.4 percent as reported and

8.3 percent when currency impacts are removed. This

increase was primarily driven by the high-growth areas

of the company’s product portfolio: services, hard disk

drive (HDD) storage products and distributed software

offerings including those from Tivoli Systems, Inc. (Tivoli).

The following table provides the company’s percent of

revenue by category:

1997 1996 1995

Hardware sales 46.1% 47.8% 49.5%

Services 24.6 20.9 17.7

Software 16.4 17.2 17.6

Maintenance 8.1 9.2 10.3

Rentals and financing 4.8 4.9 4.9

___________ ___________ ___________

Total 100.0% 100.0% 100.0%

The overall gross profit margin at 39.0 percent decreased

1.2 points from 1996, following a 2.0 point decrease in

1996 over 1995. The declines were primarily the result of

the company’s continued shift to the higher growth

sources of revenue, most notably, services in 1997 and

services and personal computers in 1996. These busi-

nesses have lower gross profit margins than the

company’s high-end hardware offerings (System/390 and

AS/400), which declined as a percent of total revenue.

management discussion

International Business Machines Corporation

and Subsidiary Companies

40