IBM 1997 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 1997 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

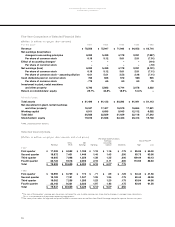

notes to consolidated financial statements

International Business Machines Corporation

and Subsidiary Companies

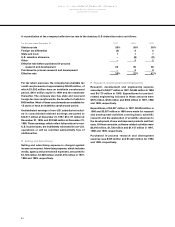

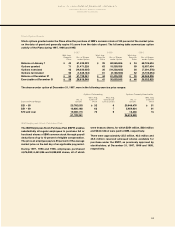

Non-U.S. Plans: Most subsidiaries and branches outside the U.S. have retirement plans covering substantially all regular

employees, under which funds are deposited under various fiduciary-type arrangements, annuities are purchased under

group contracts or reserves are provided. Retirement benefits are based on years of service and the employee’s

compensation, generally during a fixed number of years immediately prior to retirement. The ranges of assumptions used

for the non-U.S. plans reflect the different economic environments within various countries.

In 1994, the company introduced a non-qualified U.S. Supplemental Executive Retirement Plan (SERP) effective

January 1, 1995, which is being phased in over three years. The SERP, which is unfunded, provides eligible executives

defined pension benefits outside the IBM Retirement Plan, based on average earnings, years of service and age at

retirement. At December 31, 1997 and 1996, the projected benefit obligation was $128 million and $93 million, respectively.

The net unrecognized costs of the SERP were $72 million and $57 million, and the amounts included in the Consolidated

Statement of Financial Position were pension liabilities of $56 million and $36 million at December 31, 1997 and 1996,

respectively. The cost of the SERP, which is included in the Consolidated Statement of Earnings, was $20 million,

$19 million and $15 million for 1997, 1996 and 1995, respectively.

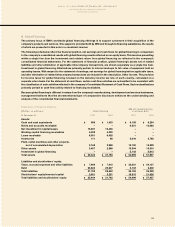

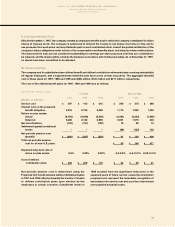

X Nonpension Postretirement Benefits

The company and its U.S. subsidiaries have defined benefit postretirement plans that provide medical, dental and life

insurance for retirees and eligible dependents. Plan cost maximums for those who retired prior to January 1, 1992, will

take effect beginning with the year 2001. Plan cost maximums for all other employees take effect upon retirement.

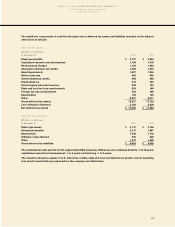

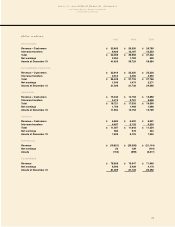

Net periodic postretirement benefit cost for the U.S. plan for the years ended December 31 included the following

components:

1997 1996 1995

(Dollars in millions)

Service cost $32 $43 $40

Interest cost on the accumulated postretirement benefit obligation 455 478 520

Actual return on plan assets (15) (68) (198)

Net amortizations and deferrals (119) (87) (7)

________________ _______________ _______________

Net periodic postretirement benefit cost $353 $366 $355

Expected long-term rate of return on plan assets 5.0% 9.25% 9.25%

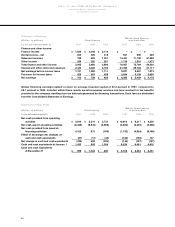

During 1997, the expected long-term rate of return on plan assets was reduced to 5 percent as a result of the shift in

the asset portfolio. Certain of the company’s non-U.S. subsidiaries have similar plans for retirees. However, most

retirees outside the United States are covered by government-sponsored and -administered programs, and the

obligations and cost of these programs are not significant to the company.