Holiday Inn 2006 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2006 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

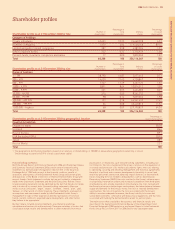

Shareholder profiles

IHG Useful information 95

Percentage of Percentage

Number of total Ordinary of issued

Shareholder profile as at 31 December 2006 by type shareholders shareholders shares share capital

Category of holdings

Private individuals 63,603 93.25 24,660,398 6.92

Nominee companies 3,979 5.84 319,528,768 89.74

Limited and public limited companies 387 0.58 4,389,904 1.23

Other corporate bodies 222 0.33 3,716,939 1.04

Pension funds, insurance companies and banks 17 0.00 3,820,040 1.07

Total 68,208 100 356,116,049 100

Percentage of Percentage

Number of total Ordinary of issued

Shareholder profile as at 31 December 2006 by size shareholders shareholders shares share capital

Range of holdings

1 – 199 38,790 56.87 2,617,445 0.73

200 – 499 14,620 21.43 4,728,867 1.33

500 – 999 7,767 11.39 5,457,123 1.53

1,000 – 4,999 5,891 8.64 10,874,513 3.05

5,000 – 9,999 361 0.53 2,464,002 0.69

10,000 – 49,999 375 0.55 8,361,792 2.35

50,000 – 99,999 98 0.14 7,039,036 1.98

100,000 – 499,999 192 0.28 44,941,630 12.62

500,000 – 999,999 56 0.08 40,440,812 11.36

1,000,000 – highest 58 0.09 229,190,829 64.36

Total 68,208 100 356,116,049 100

Percentage of

Shareholder profile as at 31 December 2006 by geographical location issued share capital1

Country/Jurisdiction

England & Wales 58.28

Scotland 8.66

Rest of Europe 8.91

USA (including ADRs) 20.95

Japan 0.89

Rest of World 2.31

Total 100

1 The geographical distribution presented is based on an analysis of shareholdings of 150,000 or above where geographical ownership is known.

These holdings account for 82.19% of total issued share capital.

Glossary and Shareholder profiles and forward-looking statements

Forward-looking statements

Both the Annual Report and Financial Statements 2006 and the Annual Review

and Summary Financial Statement 2006 contain certain forward-looking

statements as defined under US legislation (Section 21E of the Securities

Exchange Act of 1934) with respect to the financial condition, results of

operations and business of InterContinental Hotels Group and certain plans

and objectives of the Board of Directors of InterContinental Hotels Group with

respect thereto. Such statements include, but are not limited to, statements

made in the Chairman’s Statement and the Chief Executive’s Review. These

forward-looking statements can be identified by the fact that they do not relate

only to historical or current facts. Forward-looking statements often use

words such as ‘anticipate’, ‘target’, ‘expect’, ‘estimate’, ‘intend’, ‘plan’, ‘goal’,

‘believe’, or other words of similar meaning. These statements are based on

assumptions and assessments made by InterContinental Hotels Group’s

management in light of their experience and their perception of historical

trends, current conditions, expected future developments and other factors

they believe to be appropriate.

By their nature, forward-looking statements are inherently predictive,

speculative and involve risk and uncertainty. There are a number of factors that

could cause actual results and developments to differ materially from those

expressed in, or implied by, such forward-looking statements, including, but

not limited to: the risks involved with the Group’s reliance on the reputation of

its brands and protection of its intellectual property rights; the risks relating

to identifying, securing and retaining management and franchise agreements;

the effect of political and economic developments; the ability to recruit and

retain key personnel; events that adversely impact domestic or international

travel, including terrorist incidents and epidemics such as Severe Acute

Respiratory Syndrome (SARS); the risks involved in the Group’s reliance upon

its proprietary reservation system and increased competition from third-party

intermediaries who provide reservation infrastructure; the risks involved with

the Group’s reliance on technologies and systems; the future balance between

supply and demand for the Group’s hotels; the lack of selected development

opportunities; the risk of litigation; the risks associated with the Group’s

ability to maintain adequate insurance; the Group’s ability to borrow and

satisfy debt covenants; compliance with data privacy regulations; and the risks

associated with funding the defined benefits under its pension plans.

The main factors that could affect the business and financial results are

described in the Operating and Financial Review of the Annual Report and

Financial Statements 2006 and also in any Annual Report of InterContinental

Hotels Group PLC on Form 20-F for 2006 and for any subsequent year.