Holiday Inn 2006 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2006 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

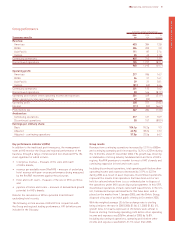

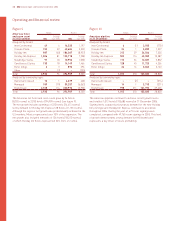

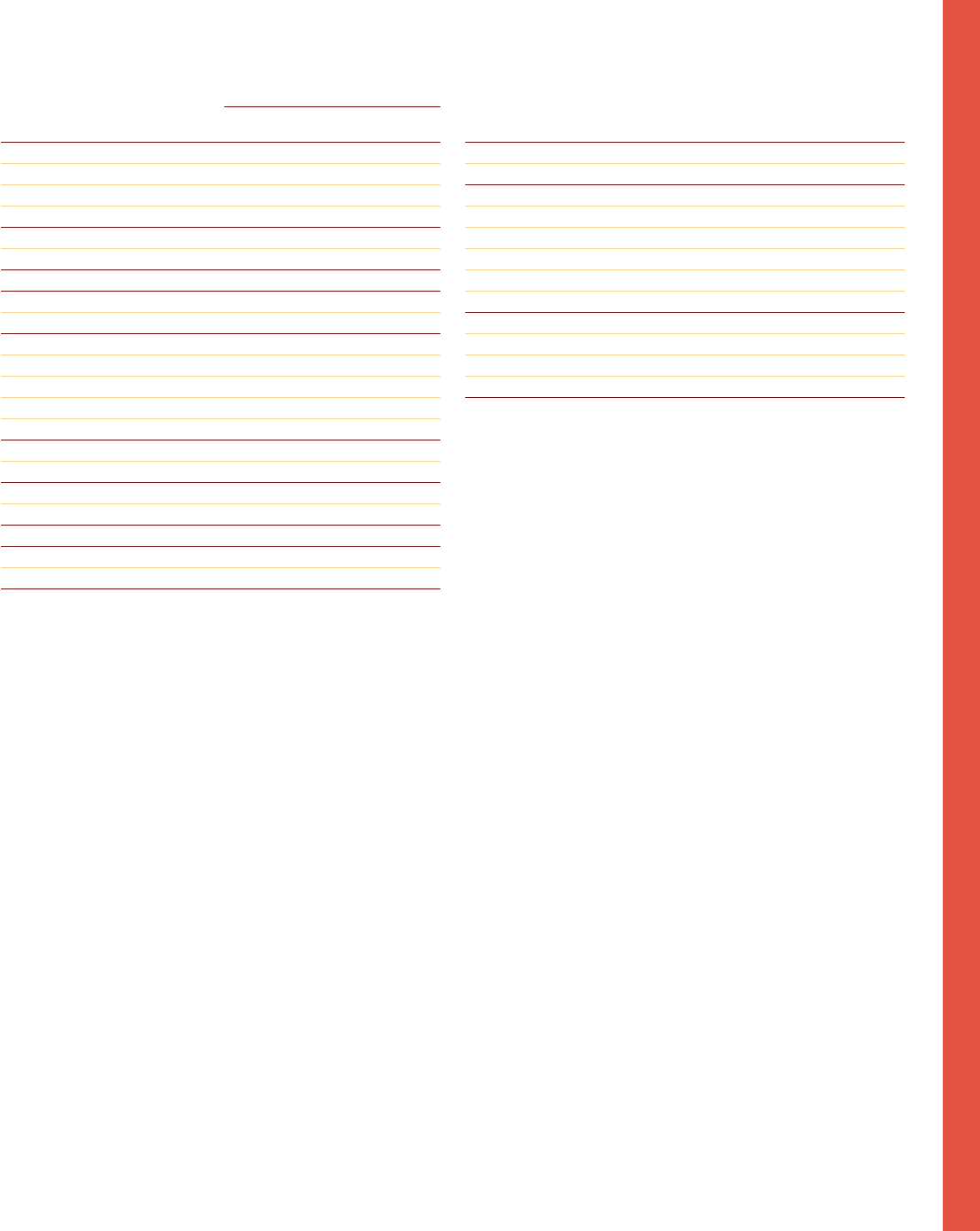

IHG Operating and financial review 11

The Americas

12 months ended 31 December

2006 2005 %

Americas results $m $m change

Revenue:

Owned and leased 211 195 8.2

Managed 143 118 21.2

Franchised 443 389 13.9

Continuing operations 797 702 13.5

Discontinued operations* 55 111 (50.5)

Total $m 852 813 4.8

Sterling equivalent £m 463 445 4.0

Operating profit before other operating income and expenses:

Owned and leased 26 25 4.0

Managed 50 36 38.9

Franchised 382 340 12.4

458 401 14.2

Regional overheads (59) (62) (4.8)

Continuing operations 399 339 17.7

Discontinued operations* 823 (65.2)

Total $m 407 362 12.4

Sterling equivalent £m 221 198 11.6

*Discontinued operations are all owned and leased.

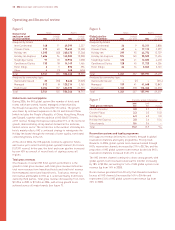

Revenue and operating profit from continuing operations increased

by 13.5% to $797m and 17.7% to $399m respectively during 2006.

Underlying trading performance across all ownership types was

strong, although the pace of RevPAR growth achieved in the first

half of the year was not maintained throughout the second

half of the year.

Discontinued operations include the results of hotels sold

during 2005 and 2006, together with four hotels currently on the

market for disposal. Including discontinued operations, revenue

grew 4.8% whilst operating profit increased by 12.4%.

Continuing owned and leased revenue increased by 8.2% to $211m.

Owned and leased InterContinental branded hotels achieved RevPAR

growth in excess of 12% over 2005, driven by gains in both daily

rates and occupancy levels (see figure 8). The owned and leased

results were impacted, as expected, by a $6m loss at the recently

opened InterContinental Boston. Excluding this loss, the combined

impact of RevPAR growth and operating efficiencies led to a 28%

increase in operating profit from continuing owned and leased hotels.

Operating and financial review

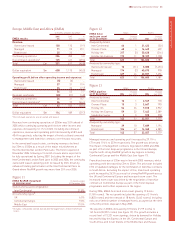

Figure 8

Americas RevPAR movement 12 months ended

on previous year 31 December 2006

Owned and leased (comparable):

InterContinental 12.2%

Managed (comparable):

InterContinental 10.1%

Crowne Plaza 14.1%

Holiday Inn 4.7%

Staybridge Suites 8.8%

Candlewood Suites 9.9%

Franchise (all hotels):

Crowne Plaza 10.3%

Holiday Inn 7.6%

Holiday Inn Express 10.7%

Managed revenues increased by 21.2% to $143m during the year

as a result of strong underlying trading, restructured management

agreements, an increased number of hotels under management

contracts and the full year benefit of contracts negotiated during

2005 as part of the hotel disposal programme. RevPAR growth in

the managed hotels was strong across most brands (see figure 8).

Holiday Inn growth levels were impacted during the fourth quarter

by hotel refurbishments (nine of 28 hotels). Managed revenues

include $80m (2005 $70m) from properties that are structured,

for legal reasons, as operating leases but with the same

characteristics as management contracts.

Managed operating profit increased by 38.9% to $50m including

$9m (2005 $9m) from the managed properties held as operating

leases and $3m from the receipt of business interruption proceeds

following hurricane damage in 2005. As a consequence of the 2005

hurricane season, ongoing insurance costs increased significantly,

reducing managed operating profit in 2006 by an incremental $3m.

Franchised revenue and operating profit increased by 13.9% to

$443m and 12.4% to $382m respectively, driven by RevPAR growth

of 9.2%, net room count growth of 4% and fees associated with

record levels of signings. The RevPAR gains were achieved across

all brands despite high prior year comparables (see figure 8).

Holiday Inn Express and Crowne Plaza both reported double digit

RevPAR growth, driven by higher daily rates.

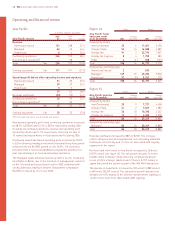

The Americas regional overheads were favourably impacted during

the year by lower claims in the Group-funded employee healthcare

programme.