Holiday Inn 2006 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2006 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

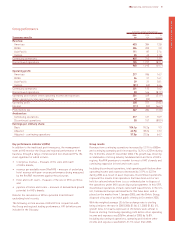

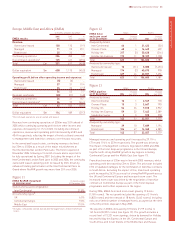

Figure 16

2006 2005

Net debt at 31 December £m £m

Borrowings (including derivatives):

Sterling 102 –

US Dollar 282 220

Euro 101 488

Other 48 71

Cash (including derivatives) (403) (686)

130 93

Excluding fair value of derivatives (net) 4(5)

Net debt 134 88

Average debt levels 92 700

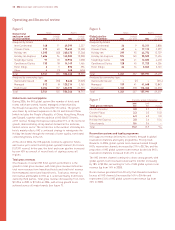

Figure 17

2006 2005

Facilities at 31 December £m £m

Committed 1,157 1,163

Uncommitted 39 14

Total 1,196 1,177

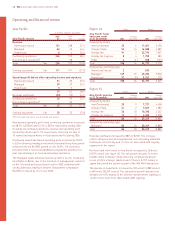

Medium and long-term borrowing requirements at 31 December

2006 were met through a £1.1bn Syndicated Bank Facility which

matures in November 2009. Short-term borrowing requirements

were principally met from drawings under committed and

uncommitted bilateral loan facilities. At the year end, the Group

had £944m of committed facilities available for drawing.

The Syndicated Bank Facility contains two financial covenants, interest

cover and net debt/Earnings before Interest, Tax, Depreciation and

Amortisation (EBITDA). The Group is in compliance with both

covenants, neither of which is expected to represent a material

restriction on funding or investment policy in the foreseeable future.

Treasury management

Treasury policy is to manage financial risks that arise in relation to

underlying business needs. The activities of the treasury function

are carried out in accordance with Board approved policies and are

subject to regular audit. The treasury function does not operate as

a profit centre.

The treasury function seeks to reduce the financial risk of the

Group and manages liquidity to meet all foreseeable cash needs.

One of the primary objectives of the Group’s treasury risk

management policy is to mitigate the adverse impact of

movements in interest rates and foreign exchange rates.

The US dollar is the predominant currency of the Group’s

revenues and cash flows and movements in foreign exchange

rates, particularly the US dollar and euro, can affect the Group’s

reported profit, net assets and interest cover. To hedge this

translation exposure, the Group matches the currency of its debt

(either directly or via derivatives) to the currency of its net assets,

whilst maximising the amount of US dollars borrowed. A general

weakening of the US dollar (specifically a one cent rise in the

sterling: US dollar rate) would have reduced the Group’s profit

before tax for 2006 by an estimated £1m.

Foreign exchange transaction exposure is managed by the forward

purchase or sale of foreign currencies or the use of currency

options. Most significant exposures of the Group are in currencies

that are freely convertible.

Interest rate exposure is managed within parameters that stipulate

that fixed rate borrowings should normally account for no less than

25%, and no more than 75%, of net borrowings for each major

currency. This is achieved through the use of interest rate swaps

and options and forward rate agreements.

Credit risk on treasury transactions is minimised by operating

a policy on the investment of surplus funds that generally

restricts counterparties to those with an A credit rating or better,

or those providing adequate security. Limits are set for individual

counterparties. Most of the Group’s surplus funds are held in the

UK or US and there are no material funds where repatriation is

restricted as a result of foreign exchange regulations.

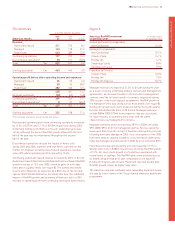

Figure 18

Interest risk profile of gross

debt for major currencies (including 2006 2005

derivatives) at 31 December %%

At fixed rates 53 36

At variable rates 47 64

Pensions

The Group operates two main schemes, the InterContinental Hotels

UK Pension Plan and the US-based InterContinental Hotels

Pension Plan. Including the unfunded element of the Plans, the

accounting deficits at 31 December 2006 were £29m and £33m

respectively.

Following the 2006 actuarial review of the UK Pension Plan,

the Group has agreed with the Plan Trustees to make a special

contribution of £40m. The special contribution will be paid over

three years with £20m in 2007 and £10m in each of 2008 and 2009.

The defined benefit section of the UK Plan is generally closed to new

members. The US Plan is closed to new members and pensionable

service no longer accrues for current employee members.

Employees

IHG employed an average of 11,456 people worldwide in the year

ended 31 December 2006.

The hospitality industry is a people-based business and as such

the Group’s HR strategy places great emphasis on the following:

•Leadership Strong leadership is central to IHG’s aim of

becoming one of the very best companies in the world. The

Company’s senior leadership programme involves the creation

of development plans for top performers, supported by

individual assessment and accredited business training and

incorporates long range succession planning;

•Development Across the Group, development training is

designed to increase the skills and knowledge of our employees

wherever they work. This year IHG launched employee

‘on-boarding programmes’ to assist new employees, in addition

to continued brand specific training and individual development

and coaching;

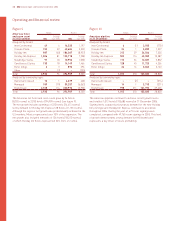

Operating and financial review

16 IHG Annual report and financial statements 2006