Holiday Inn 2006 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2006 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

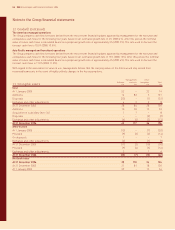

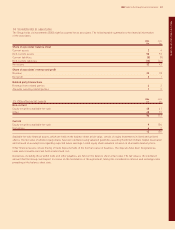

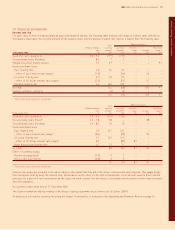

Notes to the Group financial statements

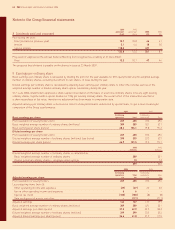

22 Financial instruments

Interest rate risk

For each class of interest bearing financial asset and financial liability, the following table indicates the range of interest rates effective at

the balance sheet date, the carrying amount on the balance sheet and the periods in which they reprice, if earlier than the maturity date.

Total Repricing analysis

Effective interest carrying Less than 6 months More than

rate amount 6 months -1 year 1-2 years 5 years

31 December 2006 %£m£m£m£m£m

Cash and cash equivalents 0.0 – 5.2 (179) (179) – – –

Secured bank loans (floating) 8.5 77–––

Obligations under finance leases 9.7 97 – – – 97

Unsecured bank loans:

Euro floating rate 4.0 54 54 – – –

– effect of euro interest rate swaps* (1.0) (54) – 54 –

US dollar floating rate 5.7 53 53 – – –

– effect of US dollar interest rate swaps* (1.2) (51) – 51 –

Sterling floating rate 5.6 102 102 – – –

Net debt 134 (68) – 105 97

Foreign exchange contracts (4) (4) – – –

130 (72) – 105 97

* These items bear interest at a fixed rate.

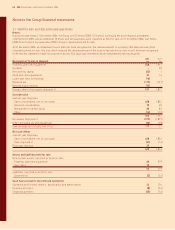

Total Repricing analysis

Effective interest carrying Less than 6 months More than

rate amount 6 months -1 year 1-2 years 5 years

31 December 2005 %£m£m£m£m£m

Cash and cash equivalents 0.0 – 4.5 (324) (324) – – –

Secured bank loans (fixed)* 6.5 – 7.8 28 – – 28 –

Secured bank loans (floating) 2.9 – 8.5 10 10 – – –

Unsecured bank loans:

Euro floating rate 2.9 141 141 – – –

– effect of euro interest rate swaps* (0.4) (55) – 55 –

US dollar floating rate 4.7 162 162 – – –

– effect of US dollar interest rate swaps* 0.2 (87) 87 – –

Hong Kong dollar floating rate 4.7 71 71 – – –

Net debt 88 (82) 87 83 –

Effect of currency swaps:

Receive and pay fixed* (1.5) 33–––

Receive and pay floating (2.0) 22–––

93 (77) 87 83 –

* These items bear interest at a fixed rate.

Interest rate swaps are included in the above tables to the extent that they affect the Group’s interest rate repricing risk. The swaps hedge

the floating rate debt by fixing the interest rate, shown above as the effect on the debt’s floating rate, on an amount equal to their notional

principal, for a period of time represented by the figures in each column. The fair values of derivatives are recorded in other financial assets

and other payables.

No currency swaps were held at 31 December 2006.

The future redemption liability relating to the Group’s loyalty programme incurs interest at US dollar LIBOR.

An analysis of net debt by currency, including the impact of derivatives, is included in the Operating and Financial Review on page 16.

IHG Notes to the Group financial statements 71