Holiday Inn 2006 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2006 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

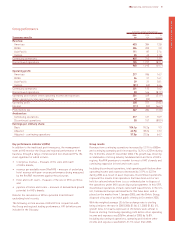

Executing the four strategic priorities is designed to achieve:

• organic growth of at least 50,000 to 60,000 net rooms by the

end of 2008 (starting from 537,000 in June 2005), with specific

growth targets for the InterContinental brand and the key

Chinese market; and

• out-performance of total shareholder return against

a competitor set.

Growth is planned to be attained predominantly from managing

and franchising rather than owning hotels. Nearly 550,000 rooms

operating under Group brands are managed or franchised (see

figure 2). The managed and franchised model is attractive because

it enables the Group to achieve its goals with limited capital

investment. With a relatively fixed cost base, such growth yields

high incremental margins for IHG, and is primarily how the Group

has grown recently. For this reason, the Group has executed a

disposal programme for most of its owned hotels, releasing capital

and enabling returns of funds to shareholders.

A key characteristic of the managed and franchised business model

on which the Group has focused is that it generates more cash than

is required for investment in the business, with a high return on

capital employed. Currently, 92% of continuing earnings before

interest, tax and regional and central overheads is derived from

managed and franchised operations.

The Group aims to deliver its growth targets through the strongest

operating system in the industry which includes:

• a strong brand portfolio across the major markets, including

two leading brands: InterContinental and Holiday Inn;

• market coverage – a presence in nearly 100 countries and

territories;

• scale – 3,741 hotels, 556,246 rooms and 130 million guest

stays per annum;

• IHG global reservation channels delivering $5.7bn of global

system room revenue in 2006, $2.0bn from the internet;

• a loyalty programme, Priority Club Rewards, contributing

$4.4bn of global system room revenue; and

• a strong web presence – holidayinn.com is the industry’s most

visited site, with around 75 million total site visits per annum.

With a clear target for rooms growth and a number of brands

with market premiums offering excellent returns for owners, the

Group is well placed to execute its strategy and achieve its goals.

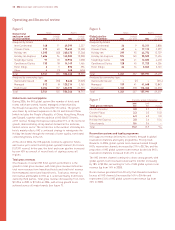

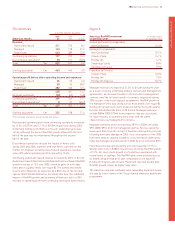

Figure 2

Business relationships

IHG maintains effective business relationships across all aspects of

its operations. However, the Group’s operations are not dependent

upon any single customer, supplier or hotel owner due to the

extent of its brands, market segments and geographical coverage.

For example, the largest hotel owner controls less than 4% of the

Group’s total room count.

To promote effective owner relationships, the Group’s management

meets with owners of IHG branded hotels on a regular basis. In

addition, IHG has an important relationship with the International

Association of Holiday Inns (IAHI). The IAHI is an independent

worldwide association for owners of the Crowne Plaza, Holiday Inn,

Holiday Inn Express, Hotel Indigo, Staybridge Suites and

Candlewood Suites brands. IHG and the IAHI work together to

support and facilitate the continued development of IHG’s brands

and systems.

Many jurisdictions and countries regulate the offering of franchise

agreements and recent trends indicate an increase in the number

of countries adopting franchise legislation. As a significant

percentage of the Group’s revenues is derived from franchise

fees, the Group’s continued compliance with franchise legislation

is important to the successful deployment of the Group’s strategy.

Owned and leased Managed Franchised

Global room count by ownership type

at 31 December 2006

IHG Operating and financial review 7

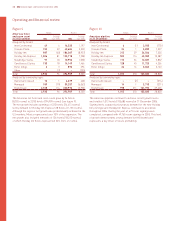

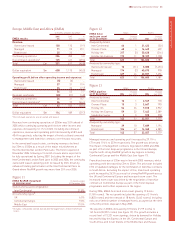

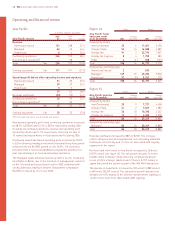

Operating and financial review