Holiday Inn 2006 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2006 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

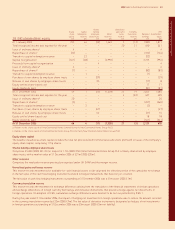

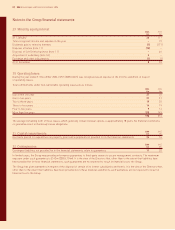

Notes to the Group financial statements

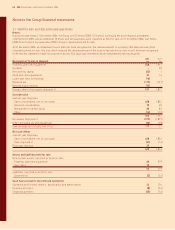

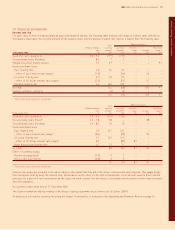

23 Employee benefits (continued)

Pension plans Post-employment

UK US benefits Total

2006 2005 2006 2005 2006 2005 2006 2005

Movement in benefit obligation £m £m £m £m £m £m £m £m

Benefit obligation at beginning of year 274 600 103 88 11 11 388 699

Current service cost 519 ––––519

Members’ contributions 12––––12

Interest expense 13 30 561119 37

Benefits paid (7) (11) (6) (6) (1) (1) (14) (18)

Plan curtailment –(7) –––––(7)

Actuarial loss/(gain) arising in the year 12 67 –3(1) (1) 11 69

Separation of Soft Drinks –(426) –––––(426)

Exchange adjustments ––(13) 12 (1) 1(14) 13

Benefit obligation at end of year 298 274 89 103 911 396 388

The defined benefit obligation comprises £340m (2005 £328m) arising from plans that are wholly or partly funded and £56m (2005 £60m)

arising from unfunded plans.

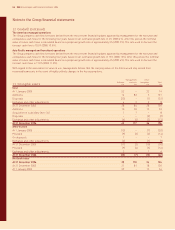

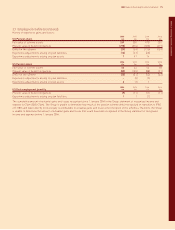

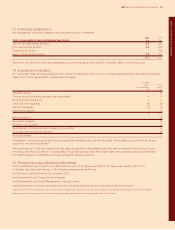

The combined assets of the principal schemes and expected rate of return were:

2006 2005

Long-term Long-term

rate of rate of

return return

expected Value expected Value

UK Schemes %£m %£m

Equities 7.9 128 7.5 125

Bonds 4.6 123 4.2 110

Other 7.9 18 7.5 15

Total market value of assets 269 250

US Schemes

Equities 9.5 34 9.6 38

Fixed income 5.5 22 5.5 24

Total market value of assets 56 62

The expected rate of return on assets has been determined following advice from the plans’ independent actuaries and is based on the

expected return on each asset class together with consideration of the long-term asset strategy.

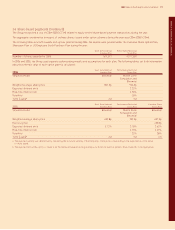

Pension plans Post-employment

UK US benefits Total

2006 2005 2006 2005 2006 2005 2006 2005

Movement in plan assets £m £m £m £m £m £m £m £m

Fair value of plan assets at beginning of year 250 470 62 56 ––312 526

Company contributions 445 1211648

Members’ contributions 12––––12

Benefits paid (7) (11) (6) (6) (1) (1) (14) (18)

Expected return on assets 14 32 45––18 37

Actuarial gain/(loss) arising in the year 747 2(1) ––946

Separation of Soft Drinks –(335) –––––(335)

Exchange adjustments ––(7) 6––(7) 6

Fair value of plan assets at end of year 269 250 56 62 ––325 312

Normal company contributions are expected to be £7m in 2007. In addition, the Group has agreed to pay special contributions of £40m to the

UK Pension Plan; £20m in 2007, £10m in 2008 and £10m in 2009.

74 IHG Annual report and financial statements 2006