Holiday Inn 2006 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2006 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

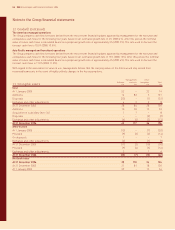

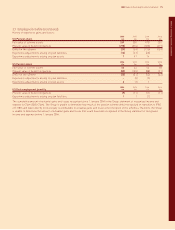

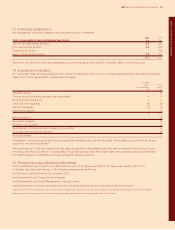

23 Employee benefits (continued)

History of experience gains and losses:

2006 2005 2004 2003

UK Pension plans £m £m £m £m

Fair value of scheme assets 269 250 470 353

Present value of benefit obligations (298) (274) (600) (477)

Deficit in the scheme (29) (24) (130) (124)

Experience adjustments arising on plan liabilities (12) (67) (60)

Experience adjustments arising on plan assets 747 14

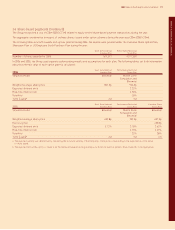

2006 2005 2004 2003

US Pension plans £m £m £m £m

Fair value of scheme assets 56 62 56 48

Present value of benefit obligations (89) (103) (88) (91)

Deficit in the scheme (33) (41) (32) (43)

Experience adjustments arising on plan liabilities –(3) (5)

Experience adjustments arising on plan assets 2(1) 1

2006 2005 2004 2003

US Post-employment benefits £m £m £m £m

Present value of benefit obligations (9) (11) (11) (11)

Experience adjustments arising on plan liabilities 11 (1)

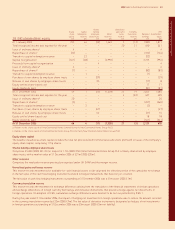

The cumulative amount of actuarial gains and losses recognised since 1 January 2004 in the Group statement of recognised income and

expense is £76m (2005 £74m). The Group is unable to determine how much of the pension scheme deficit recognised on transition to IFRS

of £178m and taken directly to total equity is attributable to actuarial gains and losses since inception of the schemes. Therefore, the Group

is unable to determine the amount of actuarial gains and losses that would have been recognised in the Group statement of recognised

income and expense before 1 January 2004.

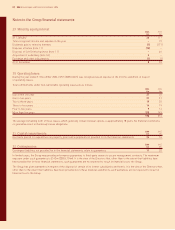

IHG Notes to the Group financial statements 75

Notes to the Group financial statements