Holiday Inn 2006 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2006 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Group financial statements

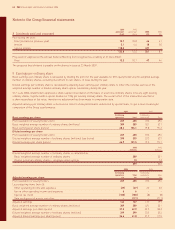

11 Held for sale and discontinued operations

Hotels

During the year ended 31 December 2006, the Group sold 32 hotels (2005 112 hotels), continuing the asset disposal programme

commenced in 2003, and an additional 10 hotels and two associates were classified as held for sale. At 31 December 2006, four hotels

(2005 26 hotels) and two associates (2005 nil) were classified as held for sale.

At 31 December 2006, an impairment loss of £3m has been recognised on the remeasurement of a property that had previously been

classified as held for sale. The loss, which reduced the carrying amount of the asset to fair value less costs to sell, has been recognised

in the income statement in gain on disposal of assets. Fair value was determined by an independent property valuation.

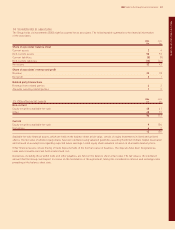

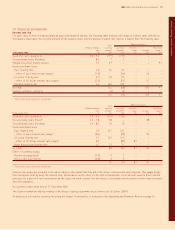

2006 2005

Net assets of hotels on disposal £m £m

Property, plant and equipment 648 1,961

Goodwill –20

Net working capital (22) 1

Cash and cash equivalents 31 16

Loans and other borrowings (10) –

Deferred tax (117) (121)

Minority equity interest (13) –

Group’s share of net assets disposed of 517 1,877

Consideration

Current year disposals:

Cash consideration, net of costs paid 628 1,832

Deferred consideration 10 40

Management contract value 30 82

Other (14) (12)

654 1,942

Net assets disposed of (517) (1,877)

Other, including tax and impairment (20) (38)

Gain on disposal of assets, net of tax 117 27

Net cash inflow

Current year disposals:

Cash consideration, net of costs paid 628 1,832

Cash disposed of (31) (16)

Prior year disposal 23 –

620 1,816

Assets and liabilities held for sale

Non-current assets classified as held for sale:

Property, plant and equipment 40 279

Associates 10 –

50 279

Liabilities classified as held for sale:

Deferred tax (2) (34)

Cash flows related to discontinued operations

Operating profit before interest, depreciation and amortisation 34 124

Investing activities (8) (54)

Financing activities (25) (16)

64 IHG Annual report and financial statements 2006