Holiday Inn 2006 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2006 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

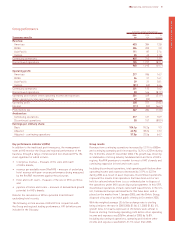

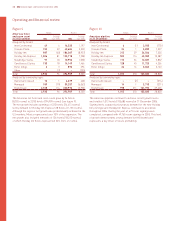

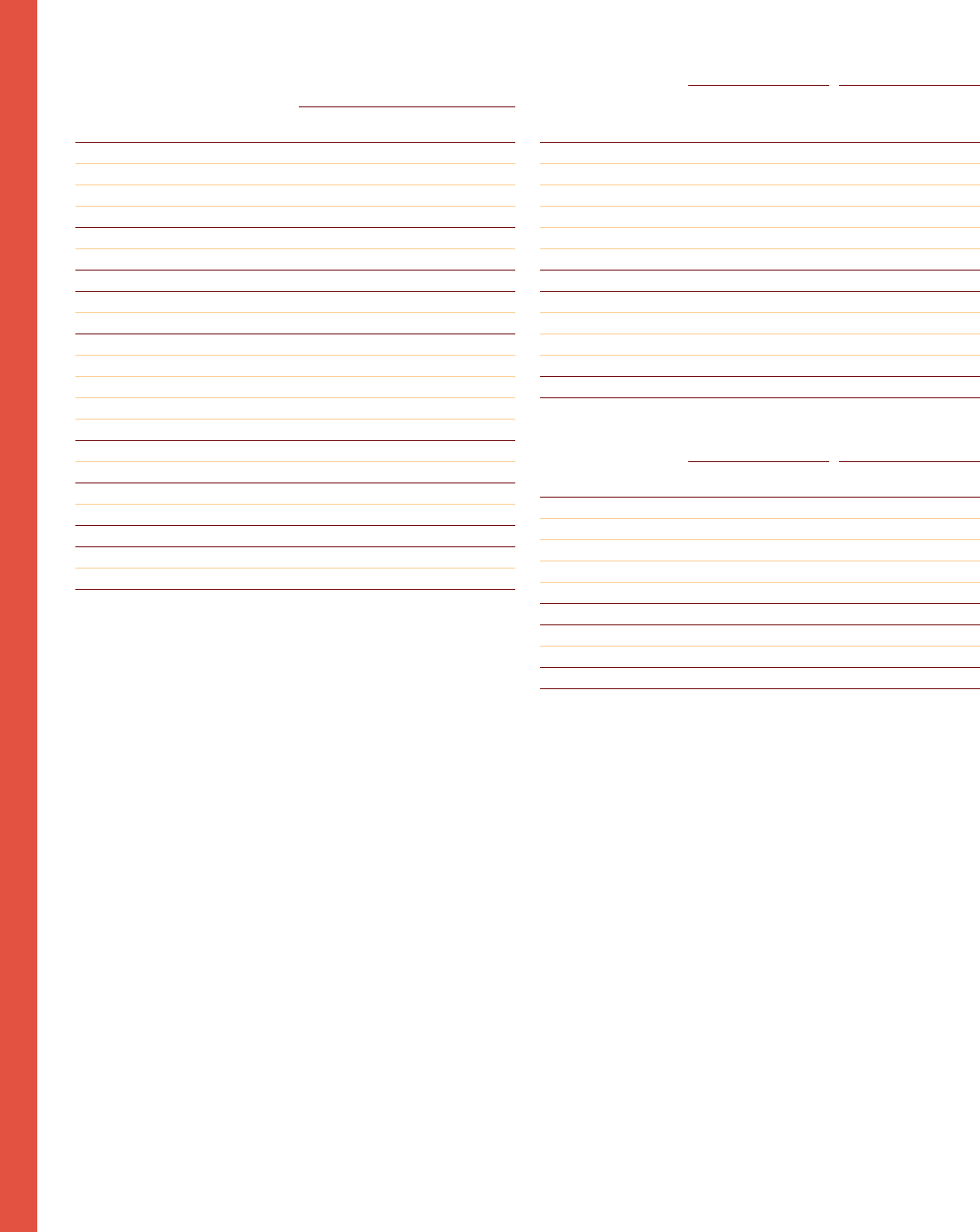

Asia Pacific

12 months ended 31 December

2006 2005 %

Asia Pacific results $m $m change

Revenue:

Owned and leased 131 108 21.3

Managed 65 45 44.4

Franchised 86 33.3

Continuing operations 204 159 28.3

Discontinued operations* –98 –

Total $m 204 257 (20.6)

Sterling equivalent £m 111 141 (21.3)

Operating profit before other operating income and expenses:

Owned and leased 31 20 55.0

Managed 39 29 34.5

Franchised 55–

75 54 38.9

Regional overheads (23) (15) 53.3

Continuing operations 52 39 33.3

Discontinued operations* –20 –

Total $m 52 59 (11.9)

Sterling equivalent £m 29 32 (9.4)

*Discontinued operations are all owned and leased.

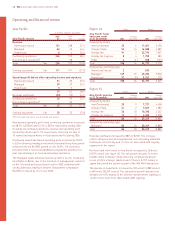

Revenue and operating profit from continuing operations increased

by 28.3% to $204m and 33.3% to $52m respectively during 2006.

Including discontinued operations, revenue and operating profit

declined by 20.6% and 11.9% respectively, reflecting the sale of

10 owned and leased hotels in Australasia and Fiji during 2005.

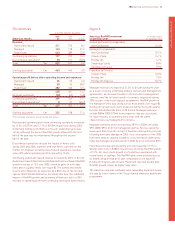

Continuing owned and leased operating profit increased by 55.0%

to $31m driven by trading at the InterContinental Hong Kong which

achieved rate-led RevPAR growth of over 30.0%. The hotel also

benefited from a rooms refurbishment programme and the prior

year repositioning of its food and beverage operations.

The managed estate achieved revenue growth of 44.4%, increasing

from $45m to $65m, due to the retention of management contracts

on the 10 owned and leased hotels sold in 2005 combined with

strong underlying trading in Greater China where comparable

RevPAR increased by 12.1% over 2005.

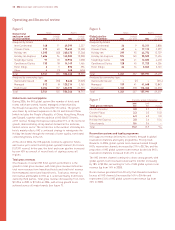

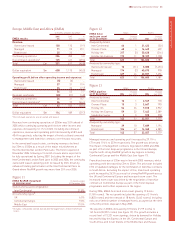

Figure 14 Hotels Rooms

Asia Pacific hotel

and room count Change Change

at 31 December 2006 over 2005 2006 over 2005

Analysed by brand:

InterContinental 33 611,651 2,190

Crowne Plaza 52 14 16,588 4,289

Holiday Inn 91 323,775 1,907

Holiday Inn Express 841,755 982

Other 4(1) 968 (139)

Total 188 26 54,737 9,229

Analysed by ownership type:

Owned and leased 2–693 –

Managed 149 29 45,282 9,050

Franchised 37 (3) 8,762 179

Total 188 26 54,737 9,229

Figure 15

Hotels Rooms

Asia Pacific pipeline Change Change

at 31 December 2006 over 2005 2006 over 2005

Analysed by brand:

InterContinental 20 97,727 4,458

Crowne Plaza 21 27,607 1,582

Holiday Inn 33 10 10,390 3,262

Holiday Inn Express 12 94,525 3,578

Total 86 30 30,249 12,880

Analysed by ownership type:

Managed 86 30 30,249 12,880

Total 86 30 30,249 12,880

Regional overheads increased by $8m to $23m. The increase

reflects infrastructure and development costs including additional

headcount, office facility and IT costs, all associated with ongoing

expansion in the region.

Net hotel and room count in Asia Pacific increased by 26 hotels

(9,229 rooms) (see figure 14). The net growth includes 14 hotels

(3,628 rooms) in Greater China reflecting continued expansion

in one of IHG’s strategic markets and 13 hotels (4,937 rooms) in

Japan that joined the system as part of the IHG ANA transaction.

The pipeline in Asia Pacific increased by 30 hotels (12,880 rooms)

to 86 hotels (30,249 rooms). The substantial growth indicates the

demand for IHG’s brands in the Chinese market where signings of

16,445 rooms were more than double 2005 signings.

Operating and financial review

14 IHG Annual report and financial statements 2006