Holiday Inn 2006 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2006 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

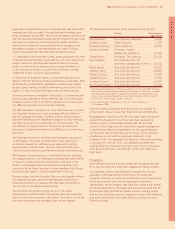

3.2 The main components

The Group has performance-related reward policies. These are

designed to provide the appropriate balance between fixed

remuneration and variable ‘risk’ reward, which is linked to the

performance of both the Group and the individual. Group

performance-related measures are chosen carefully to ensure

a strong link between reward and true underlying financial

performance, and emphasis is placed on particular areas requiring

executive focus.

The normal policy for all Executive Directors is that, using ‘target’

or ‘expected value’ calculations, their performance-related

incentives will equate to approximately 70% of total annual

remuneration (excluding pensions & benefits).

The main components of remuneration are as follows:

Base salary and benefits The salary for each Executive Director

is reviewed annually and based on both individual performance

and on the most recent relevant market information provided from

independent professional sources on comparable salary levels.

Internal relativities and salary levels in the wider employment

market are also taken into account.

Base salary is the only element of remuneration which is

pensionable.

In addition, benefits are provided to Executive Directors in

accordance with the policy applying to other executives in their

geographic location.

In assessing levels of pay and benefits, IHG compares the packages

offered by different groups of comparator companies. These groups

are chosen having regard to participants’:

• size – turnover, profits and the number of people employed;

• diversity and complexity of businesses;

• geographical spread of businesses; and

• relevance to the hotel industry.

*Using target or expected value calculations.

Base salary Short-term

incentive

Long-term

incentive

Annual bonus

plus deferred

shares (STDIP)

Performance

restricted

shares (PRSP)

Performance based

approx. 70%*

Fixed

approx. 30%*

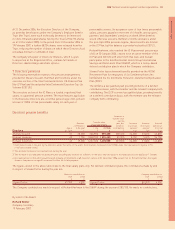

Annual performance bonus This has two elements – the Short

Term Incentive Plan (STI) and the Short Term Deferred Incentive

Plan (STDIP). Both elements require the achievement of

challenging performance goals before target bonus is payable.

The STI is linked to individual performance as measured by an

assessment of comprehensive business unit deliverables,

demonstrated leadership behaviours, and the achievement of

specific Key Performance Objectives that are linked directly to

the Group’s strategic priorities. For Executive Directors, the

target bonus opportunity under the STI in 2007 is 40% of salary,

payable in cash.

The STDIP is linked to the Group’s financial and operational

performance. The target bonus opportunity under the STDIP in

2007 is 50% of salary of which half is linked to net annual room

additions and half is linked to earnings before special items,

interest and taxation.

It is possible for participants to earn maximum bonuses of double

the targets under the STI and the STDIP. No bonus is payable if

financial and operational performance is less than 90% of target

and maximum bonus is payable if performance exceeds 110%

of target.

Under the 2006 STDIP, 80% of bonus must be paid in shares and

deferred. Participants may defer the remaining 20% of bonus on

the same terms. For 2007, 100% of the bonus will be paid in shares

and deferred. Matching shares may also be awarded up to half the

total deferred amount. Any matching award is taken into account

when the Committee decides the basic level of payment under the

STDIP. Therefore there is no separate performance test governing

the vesting of matching awards. Such awards are, however,

conditional on the Directors’ continued employment with the Group

until the release date. The shares will normally be released at the

end of the three years following deferral.

Performance restricted shares The Performance Restricted

Share Plan (PRSP) allows Executive Directors and eligible

employees to receive share awards, subject to the satisfaction of

a performance condition, set by the Committee, which is normally

measured over a three-year period. Awards are normally made

annually and, other than in exceptional circumstances, will not

exceed three times annual salary for Executive Directors.

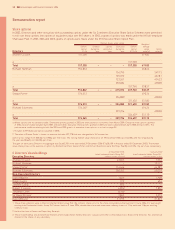

For the 2006/08 PRSP cycle, performance will be measured by

reference to:

• the increase in IHG’s Total Shareholder Return (TSR) over the

performance period relative to nine* identified comparator

companies: Accor, Hilton Hotels Corp., Choice, Marriott Hotels,

Millennium & Copthorne, NH Hotels, Sol Melia, Starwood

Hotels and Wyndham Worldwide; and

• the cumulative annual growth (CAGR) in the number of rooms

within the IHG system over the performance period relative to

eight identified comparator companies: Carlson Hospitality

Worldwide, Choice, Hilton Hotels Corp., Hyatt Hotels & Resorts,

Marriott Hotels, Sol Melia, Starwood Hotels and Wyndham

Worldwide.

*Following the delisting of De Vere Group Plc shares in September 2006.

Remuneration report

32 IHG Annual report and financial statements 2006