Holiday Inn 2006 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2006 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 IHG Annual report and financial statements 2006

Chairman’s statement

2006 was the first full year of the new strategy for the

business launched by Chief Executive, Andrew Cosslett,

in 2005. It has been a year where the change of focus in our

business has delivered strong results, and the growth

potential of the business has been demonstrated.

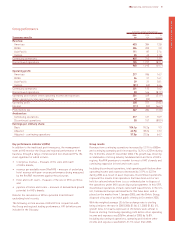

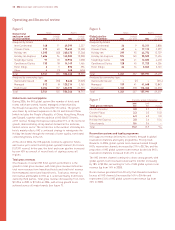

Restructuring We continued to reduce the number of hotels we own during the year.

We sold 31 hotels in Continental Europe, generating proceeds of £680 million before

transaction costs, and retained all of them within our brand family under long term

contracts. The proceeds from hotels sold since April 2003 is now £3 billion, leaving

us owning approximately £1 billion (net book value) of hotels real estate.

Shareholder returns We made further returns to shareholders during the year,

bringing the total returned since March 2004 to over £2.7 billion. A further £31 million

remains to be returned through our ongoing share buyback programmes.

We are pleased to have announced a further £850 million return of funds,

comprising a £150 million share buyback and a £700 million special dividend,

with a proposed share consolidation. The special dividend payment and share

consolidation are due to be completed by the end of June 2007, and further

details will be sent to shareholders in due course.

Dividend increase As we come to the end of restructuring our capital base,

the Board is recommending a significant increase to the final dividend for 2006,

taking it to 13.3p per share. This will give a full year dividend of 18.4p, 20 per cent

higher than in 2005. Subject to approval at the Annual General Meeting, the final

dividend will be paid on 8 June 2007 to shareholders registered on 23 March 2007.

Board Richard Hartman, President of our Europe, Middle East and Africa region,

(EMEA) announced during 2006 that he would retire in September 2007, after

eight years with the Group. Richard has done an outstanding job leading EMEA

during a period of rapid change. Sir Howard Stringer has also stood down as

a Non-Executive Director, after three years on the Board. Howard provided

wise counsel through IHG’s early years. We thank them both for their service

and wish them well for the future.

Outlook The results we achieved in 2006 were the product of exceptional work by

our people across the Group. We have a clear position as the most owner-focused

global hotel company, with a deep understanding of what guests want from our

hotel brands. This will allow us to offer our employees and business partners

attractive growth opportunities and create further value for shareholders.

Accordingly, we continue to feel confident about the prospects for the Group.

David Webster Chairman