Holiday Inn 2006 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2006 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

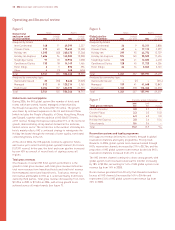

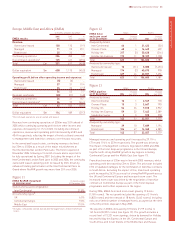

Operating and financial review

Investment with All Nippon Airways (ANA)

In December 2006, IHG invested £10m for a 75% stake in a hotel

joint venture with ANA, IHG ANA Hotels Group Japan LLC

(IHG ANA), increasing IHG’s portfolio in Japan from 12 hotels

(3,686 rooms) to 25 hotels (8,623 rooms). As part of the transaction,

ANA has signed 15 year management contracts with IHG ANA for

its 13 owned and leased hotels (4,937 rooms).

Key owned and leased assets

In November 2006, IHG reopened the InterContinental London Park

Lane following the substantial completion of a major refurbishment

and opened the newly built InterContinental Boston.

Asset disposal programme

During 2006, IHG achieved further progress with its asset disposal

programme, including:

• the sale of 24 hotels in Continental Europe to a subsidiary of

Westbridge Hospitality Fund LP for £240m, before transaction

costs. IHG retained a 15 year franchise contract on each of the

hotels; and

• the sale of seven European InterContinental hotels to

Morgan Stanley Real Estate Funds (MSREF) for £440m,

before transaction costs. IHG retained a 30 year management

contract on each of the hotels, with two 10 year renewals at

IHG’s discretion. The long-term contracts ensure continued

representation of the InterContinental brand in key European

markets.

These transactions support IHG’s continued strategy of growing its

managed and franchised business whilst reducing asset ownership.

Since April 2003, 174 hotels with a net book value of £2.9bn have

been sold, generating aggregate proceeds of £3.0bn. Of these

174 hotels, 156 have remained in the IHG system through either

franchise or management agreements.

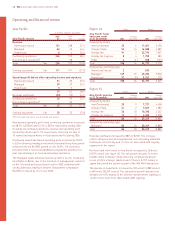

Return of funds programme

In the year, IHG paid a £497m special dividend, completed a second

£250m share buyback and substantially completed a third £250m

share buyback. Since March 2004, IHG has returned £2.7bn to

shareholders.

On 20 February 2007, a further £850m return of funds was

announced, comprising a £700m special dividend with share

consolidation and a £150m share buyback.

Management and organisation

In 2006, there were no significant changes to the management

and organisation of the Group. During the year, the Group focused

on realising benefits from the prior year global realignment of

functions, including Finance, Human Resources and Information

Technology.

The following announcements relating to members of the Executive

Committee were made during 2006:

• the appointment of Tom Conophy in January 2006 as Chief

Information Officer (CIO), a new position created to develop the

global technology strategy across IHG’s brands, leveraged by

his 25 years of experience in the Information Technology (IT)

industry; and

• the retirement of Richard Hartman, President, EMEA, effective

from September 2007.

8 IHG Annual report and financial statements 2006

Significant developments

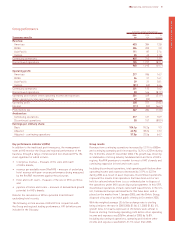

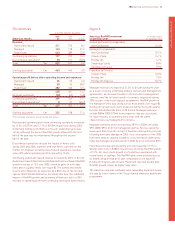

Figure 3

Asset disposal programme detail Number of hotels Proceeds Net book value

Disposed since April 2003 174 £3.0bn £2.9bn

Remaining owned and leased hotels 25 – £1.0bn

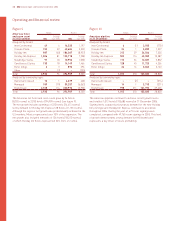

Figure 4

Return of funds programme Timing Total return Returned to date Still to be returned

£501m special dividend Paid December 2004 £501m £501m Nil

First £250m share buyback Completed in 2004 £250m £250m Nil

£996m capital return Paid July 2005 £996m £996m Nil

Second £250m share buyback Completed in 2006 £250m £250m Nil

£497m special dividend Paid June 2006 £497m £497m Nil

Third £250m share buyback Under way £250m £219m £31m

£700m special dividend Quarter 2 2007 £700m – £700m

£150m share buyback Yet to commence £150m – £150m

Total £3,594m £2,713m £881m